Sea reported Q4 2024 and FY2024 Earnings on 4th March 2025.

Revenue: $5B v $4.63B est. (+36.9% YoY)

EPS: $0.40 v $0.44 est.

Revenue had a HUGE top-line beat, considering growth was only expected to be 28%.

Earnings came in below expectations but is not a key concern considering that the magnitude of earnings is not important at this point.

This was an extremely impressive quarter by all regards.

Stock was up +12% after the earnings report and closed +7% amidst a weak day.

Key Earnings Highlights:

E-Comm (Shopee) Revenue: $3.7B (+41.3% YoY)

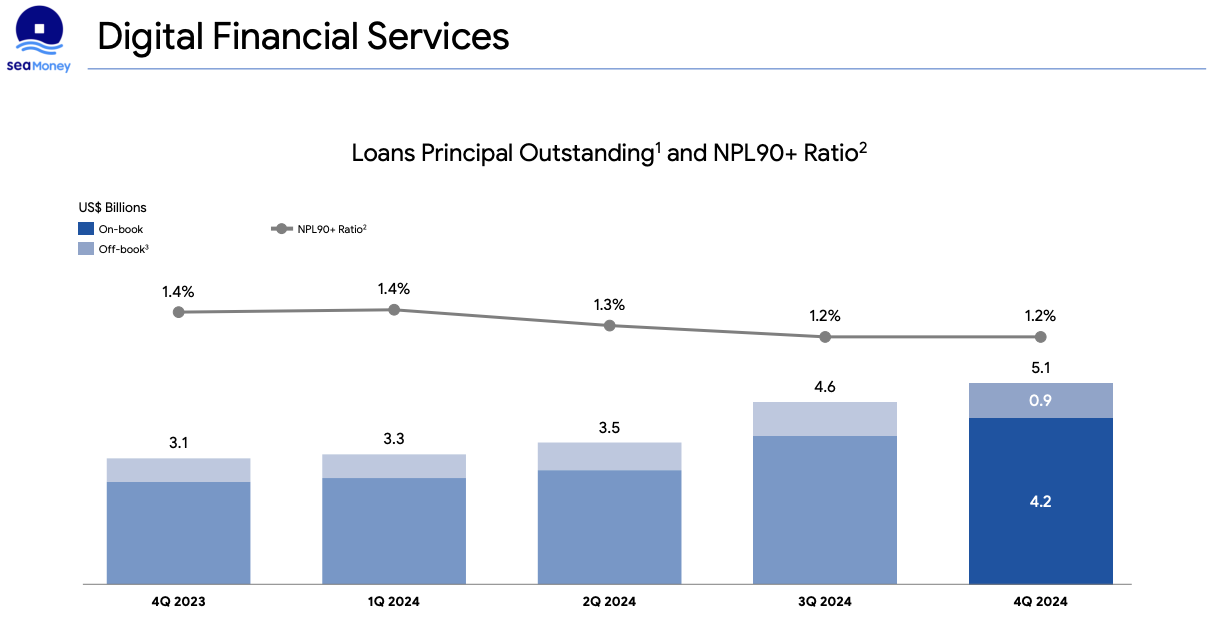

DFS (SeaMoney) LPO: $5.1B (+63.9% YoY)

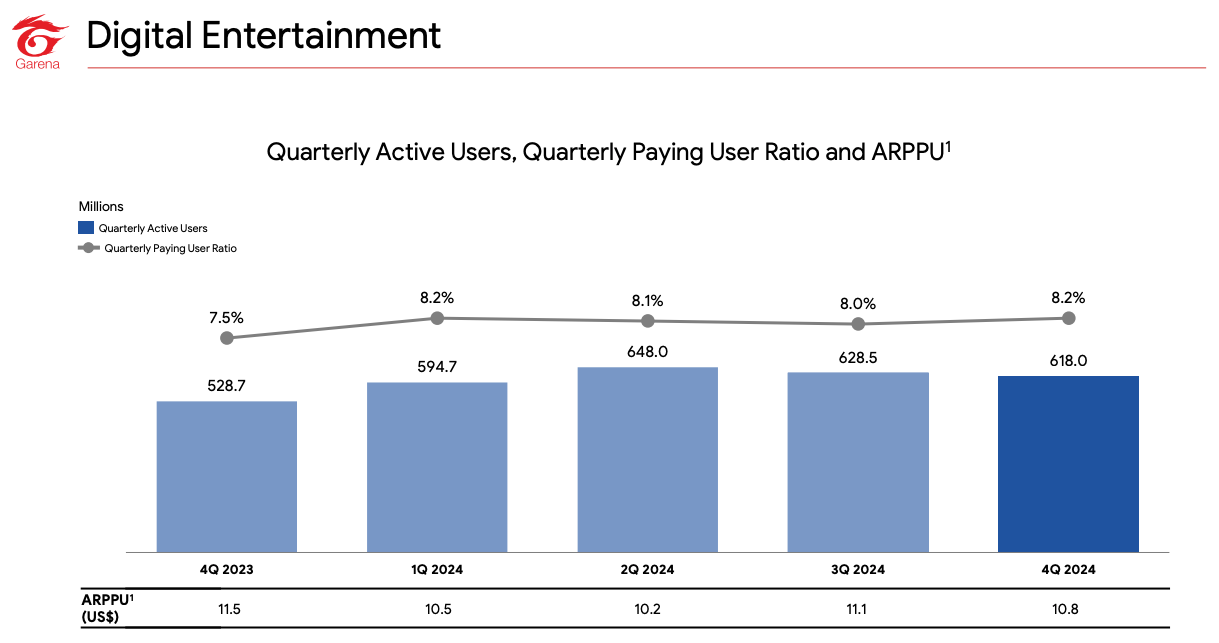

DE (Garena) Bookings: $543.2M (+19% YoY)

All 3 business segments are growing extremely well.

Firstly, Shopee is growing extremely well, with 36.9% YoY growth rates frankly something I wasn’t expecting, even with my own bullish prospects.

SeaMoney is growing as per usual, and while it has slowed down in Q4, it is not necessarily a concern considering the law of large numbers.

Garena is particularly impressive with Free Fire being seen as a “dead game” to analysts just a few quarters ago.

E-Commerce / Shopee:

Strong Growth & Focus on Profitability:

Shopee surpassed $100B in GMV in FY2024. This is now the 3rd largest e-commerce business in the world by GMV, only behind Amazon and Alibaba.

Full-Year Adj. EBITDA positive

Delivered 28% YoY GMV growth for FY2024, exceeding guidance

Guiding for 20% YoY GMV growth for FY2025

Strong performance in Brazil with positive adjusted EBITDA for the 2nd consecutive quarter. Avg monthly active buyers grew by >40% YoY.

Ad Effectiveness Improving:

Ad revenue rose >50% YoY in Q4 2024

Ad take rate improved by >50bps YoY.

Logistics and Content:

Almost half of SPX Express orders in Asia were delivered in <2 days.

Logistics cost-per-order reduced by 5 cents YoY in 4Q 2024.

Average daily unique streamers & viewers up >40% and >30% respectively

Live Streaming now counts for ~15% of all orders.

My Personal Thoughts:

This is a business that is growing exceptionally well, in spite of fears of competition from TikTok Shop.

Metrics have shown that TikTok Shop is growing extremely quickly and I see that in-person as well. It is a formidable competitor. Yet, Shopee has proven time and time again that it is #1 and TikTok Shop is likely stealing market share from the likes of Lazada and Tokopedia.

Strong growth in Brazil is particularly encouraging as it is a key lever for future growth. Management clearly understands that emerging markets are where their competencies are at. They have tried and failed in Europe but are incredible at what they do in SEA, Taiwan and now LatAm.

Ad take rates going up are a clear sign that the business is sustainable.

SPX Express is one of the key gems of the Shopee business, and is THE differentiating factor between Shopee and other e-comm businesses in the region

The content ecosystem growing like a weed is encouraging and not surprising considering the partnership with YouTube.

Digital Financial Services / SeaMoney:

Robust Growth without Excessive Risk:

Loans principal outstanding grew >60% YoY in Q4 2024

SeaMoney added 5 million first-time borrowers in Q4 2024

Consumer and SME loans active users grew >60% YoY reaching >26 million

NPL90+ ratio remains stable and low at 1.2%

Driving Off-Shopee Growth:

SeaMoney plans to diversify off-Shopee to give itself access to a much larger pool of consumer spend

Across Asia markets, off-Shopee loans accounted for about 1/2 of total loan book

Credit Card penetration is still very low in most markets, SPayLater product by SeaMoney acts almost as a virtual credit card

My Personal Thoughts:

SeaMoney has been the least talked about business of the 3 and in my opinion, the most under-rated. In fact, of the 3 businesses, I expect SeaMoney to have the greatest long-term potential.

Adding 5 million first-time borrowers in a quarter is pretty insane. That is 20 million people a year, or 4x the size of Singapore’s population.

NPL ratio staying at 1.2% despite 60% growth shows prudence by management and is again, very encouraging.

I think SeaMoney is currently at the stage where they simply need to keep using the same strategy to gain more users. This will be followed by the stage where they introduce new products and improve profitability. For now, growth is strong and management is doing the right thing. No qualms here.

Digital Entertainment / Garena:

Free Fire:

Annual bookings grew by 34% YoY. Average DAUs grew 28% YoY, standing well above 100 million.

Free Fire was the world’s largest mobile game by average DAUs in 2024.

Africa has become one of the fastest growing regions; active users in Nigeria surged 90% YoY in Dec 2024.

Localised Content + High-Profile Collabs:

Started 2025 with a Free Fire and Naruto collaboration

Celebrated local festivals with thematic in-game elements

Collaborated with Demon Slayer and Blue Lock

Free Fire has accumulated more than one trillion views to date

My Personal Thoughts:

Those who have followed me for awhile now know that I have always harped on the fact that Free Fire is an evergreen franchise, just like many other successful games of its ilk. Think Call of Duty, FIFA, Madden, GTA. These games last for DECADES not just years. I think this earnings report proves it. Free Fire is here to stay.

QAUs going back up to 8.2% is encouraging, representing a 70 basis point increase YOY.

For me, Garena will fade in relevance to Sea’s overall results in the quarters to come, owing to the other 2 businesses growing at much faster rates and now at the inflection point of profitability.

However, Garena remains a strong cash-generating business and will contribute to $SE’s enterprise value significantly for years to come.

Key Earnings Call Highlights:

*Note: I have paraphrased some of these quotes without changing the actual meaning for ease of viewing.

On YouTube Collaboration:

“We continue to see positive momentum from our collaboration with YouTube, which enables video viewers to make seamless purchases from Shopee. In Indonesia, average daily orders attributed to YouTube content in January this year have grown more than sixfold since the collaboration first launched in September last year. We are also seeing promising results since launching the collaboration in Thailand and Vietnam, and we look forward to expanding this partnership to more markets this year.”

With TikTok dominating on the video commerce end, it is encouraging to see that Shopee is trying their hand at it, and seemingly being extremely successful too. In terms of video content, it is hard to see past the big 3: TikTok, YouTube, Instagram. It is therefore key for Shopee that they work closely with YouTube. Relying on their standalone Live-Streaming within the app is not sufficient.

On Free Fire:

“We like to focus on capturing the local trends and hot topics, embedding them into the game to make it relevant, both on a global and local level. Free Fire is not just a game anymore, it has become a phenomenon from a hot topic, trending topic standpoint across social media. This helps us continually attract more users and to keep our existing users engaged.”

Free Fire has certainly cemented its legacy as an evergreen franchise with extremely rapid growth rates even into its 8th year. I think management has clearly found a strategy that works. Personally, having played Free Fire and other similar first-person shooter games, engagement is key in retaining users. Continual updates are important in ensuring that users don’t get fatigued of playing the game.

On Shopee Take Rates:

“Regarding the take rate, there are two parts. One, the commission part, and other is ad take rates. On both fronts, we see potential room to grow. The fluctuations of seasonalities will not impact the trend drastically but it will impact it. However, we think we can still grow it even with seasonality effects.”

It’s good to hear that management still believes there is flexibility and potential for take rates to continue increasing considering they have increased quite a bit in the past few years. It is an encouraging sign that likely shows competition is not that large of a threat to the business at this point and the moat created by its SPX logistics business is likely larger than most envision.

Conclusion:

Overall, this was a brilliant quarter for Sea Limited, exceeding my expectations.

Management is executing extremely well on all 3 businesses and now look like a very experienced team, calm and collected in their answers.

I have no complaints about this report and this further cements my conviction in the business and why it remains my top holding.

The coming quarters will certainly be tricky as comps are much tougher compared to 2022/2023. I will re-evaluate this quarter by quarter and also look out for any changes in the competitive landscape, especially with regard to e-commerce.

However, as repeated ad-nauseam, this is a decades-long thesis, with the primary thesis being a demographic tailwind in SEA, supported by an exceptional management team.

Until the next earnings call, thank you for reading!

Disclaimer: I am long Sea Limited. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

Can you help me understand how SEA has $2.3bn of DFS revenue on $5.1bn loan book? If this is purely loans, it is 40% interest rate? Are there significant fee income?

Incredible earnings! Added this morning at $128, but after reviewing more in-depth, I'm going to add even more tomorrow.