Hey all, I have some news for subscribers that you will find at the bottom of this article.

For now, let’s dig into Sea Limited’s Q1 2025 Earnings!

Sea Limited reported their Q1 2025 Earnings on 13th May 2025.

Revenue: $4.84B v $4.89B est. (+29.6% YoY)

EPS: $0.65 v $0.60 est.

Adj. EBITDA: $946.5M v $657M est. (+135.9% YoY)

CEO Forrest Li’s Commentary:

“We have delivered another great quarter of strong growth with improving profitability across all three businesses.”

“Shopee achieved record-high GMV and gross order volume in Q1, sustaining market leadership with improved profitability in Asia and Brazil.”

“SeaMoney, now rebranded to Monee, grew revenue and adjusted EBITDA more than 50% YoY, while maintaining stable asset quality.”

“Garena had its best quarter since 2021, driven by Free Fire’s collaboration with NARUTO and a resurgence in engagement.”

Yet again, we saw a fantastic quarter. Revenue came in below expectations, owing to seasonality, but revenue growth was nearly 30%, a huge feat regardless.

The stock closed the day up +8% on the earnings report.

As usual, I will run through the key highlights of the earnings and round up with my thoughts.

Key Earnings Highlights

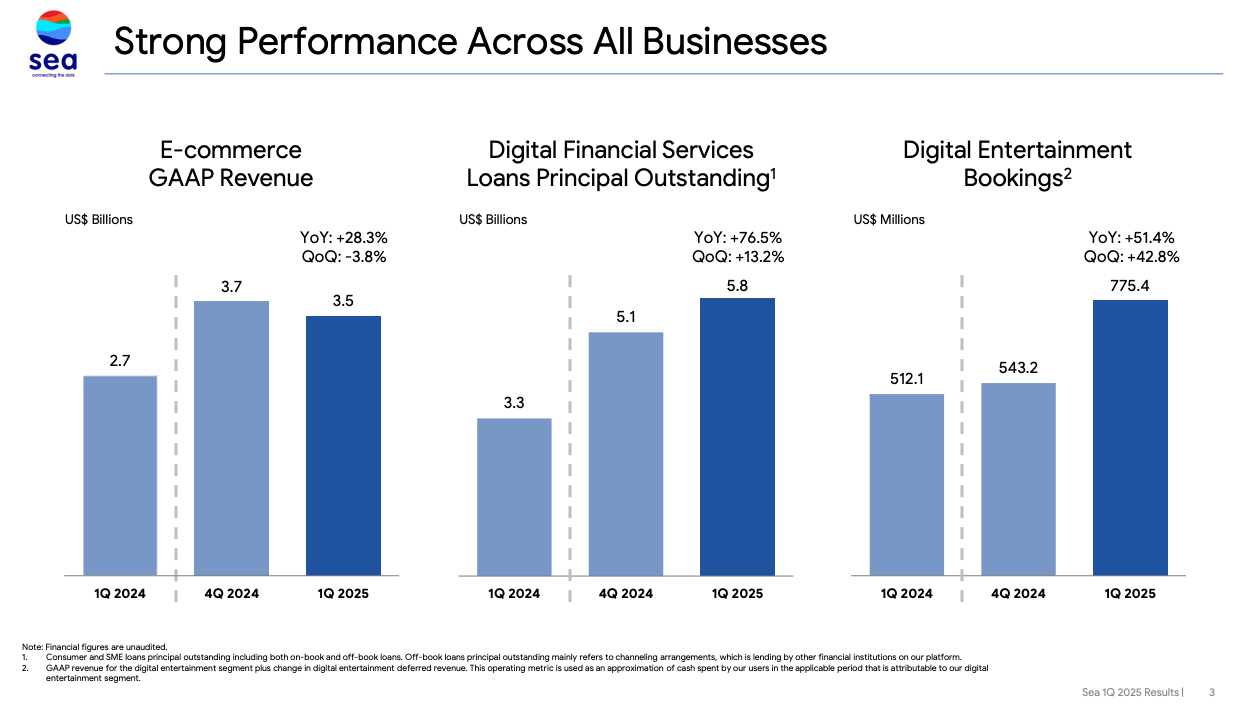

Top-Line Metrics:

E-Commerce (Shopee)

GAAP Revenue: $3.5B (+28.3% YoY)

Digital Financial Services (Monee)

Loans Principal Outstanding: $5.8B (+76.5% YoY)

Digital Entertainment (Garena)

Bookings: $775M (+51.4% YoY)

My Take:

All 3 business segments continue to grow extremely well/

Shopee saw no material impact to the business with revenue growing at 28.3% YoY. This is significant, considering this is now a $14B annualised run-rate business.

Monee saw a quarter on quarter acceleration in LPO with freakish YoY growth rates.

Garena is perhaps the most impressive of the 3 segments this quarter, with bookings up 42.8% QoQ (!!)

This is the best quarter since 2021, proving once again that this is an evergreen franchise.

E-Commerce / Shopee

E-Commerce GMV was flat QoQ but more importantly, up 21% YoY.

Management has set the target at 20% GMV growth for FY 2025 and it is well on the way to hit it.

My bet on Shopee is that we see double-digit growth rates for over a decade to come, and that isn’t priced in yet.

Adjusted EBITDA is starting to enter the hockey stick part of the curve, and in the coming quarters to years, we are about to see Shopee reap the rewards of all the sales and marketing dollars that it has poured into the business over the past decade.

Key Metrics for E-Commerce:

Ad revenue grew >50% YoY in 1Q 2025.

Number of sellers who spent on ad products and average ad spend increased by 22% and 28% YoY respectively.

SPX has allowed Shopee to lower logistics cost-per-order by 6% YoY in Asia and 21% YoY in Brazil, while delivery times have improved.

There are now >4 million YouTube videos with Shopee product links embedded as of March 2025.

My Take:

This is a business that continues to grow well despite fears of TikTok’s rise.

It is undeniable that TikTok Shop is growing extremely quickly. However, Shopee has proven its ability to reinvent itself and to retain market share.

Ultimately, the losers will be the smaller players: Lazada, Tokopedia.

Another thing of note is that the majority of purchases on Shopee are “intent-based”, while TikTok operates largely an “impulse-based” model.

The YouTube-Shopee partnership is an interesting experiment, and it will be fun to watch if it can rival TikTok.

Digital Financial Services / Monee

Monee’s NPL ratio continues to trend downwards despite blistering growth rates.

Loans Principal Outstanding grew by over 75% YoY in 1Q 2025.

Consumer and SME loans active users grew over 50% YoY, exceeding 28 million by 1Q 2025. That is a mere 4% of the Southeast Asian population.

Key Takeaway:

“We remain confident of achieving guidance of loan book size to grow meaningfully faster than Shopee’s GMV annual growth rate in 2025.”

Monee has been focused on off-Shopee loan growth, which I view to be very important.

Shopee has been a huge flywheel for Monee, but for Monee to truly be a giant in the region, it has to expand outside of the Shopee universe.

My Take:

An absolutely brilliant business that is severely underrated by the market.

I have maintained my stance that I believe this is going to be the big winner for Sea Limited over the coming decade.

Garena was the first iteration, Shopee the second, and Monee I believe will be the gem of the business.

Financial Services is a highly lucrative segment, and as I like to highlight, >60% of Southeast Asians remain unbanked/underbanked.

Monee, along with many other players, will change this. There is enough space for multiple players to thrive.

Digital Entertainment / Garena

Garena’s QPU ratio has stayed stagnant over the past few quarters at ~8.1%, so it is great to see a strong uptick in the QPU ratio to 9.8%.

QAUs have also grown considerably, up 11% YoY.

Notably, this is Garena’s strongest quarter since 2021, at the height of the pandemic.

Adjusted EBITDA as % of Bookings rose considerably to 59.1% while Bookings grew a whopping 42.8% QoQ.

Management has attributed this to the collaboration with NARUTO SHIPPUDEN.

Free Fire continues to be the world’s largest mobile game by average DAUs and downloads.

Apart from Free Fire, Garena continues to push out new games.

Delta Force Mobile was published across SEA, MENA and LATAM in April and has seen good traction with over 10 million downloads.

Free City, Garena’s version of GTA, has started pre-registration and will launch in phases beginning in May.

My Take:

I have been pleasantly by the re-acceleration of Garena’s business both in top-line and bottom-line key metrics.

This understates that Free Fire is indeed an evergreen franchise, going into the 8th year.

As I have stated ad-nauseam, I believe Free Fire is a franchise game, similar to the likes of Call of Duty, FIFA, Madden etc…

These games last for decades, not years.

The market has certainly not recognised that yet.

Key Earnings Call Highlights:

*Note: I have paraphrased some of these quotes without changing the actual meaning for ease of viewing

On Tariff Uncertainty:

"We have not seen a material impact to our Shopee growth from the macro side.

We are very much a local marketplace. Our cross-border business has been a relatively small % of our overall business."

One of the key concerns for many shareholders post-Trump tariffs was the impact that these tariffs would have on the business.

I also wrote a longer post on X addressing this.

On Capital Allocation:

"All 3 businesses are self-sufficient and constantly generating cash quarter by quarter.

We are actively monitoring our cash position and thinking through what is the best way to allocate that capital."

This is not a surprise and is a large part of the thesis. All 3 of Sea’s business segments are long-term cash-generating machines.

They essentially operate marketplaces that have huge operating leverage in the long run. I think we are at the point where we can assume Sea Limited will be in the process of planning for buybacks in the coming quarters to years.

On SPX Logistics:

"We have been working a lot on infrastructure, not only lowering down the cost, but also shortening delivery time.

If you look at 1Q25 vs. last year, we have shortened our delivery time by 2-3 days, which has a meaningful impact on the experience."

SPX Logistics has been the key to Shopee’s success and dominance over its rivals. Shopee previously relied on logistics partners such as J&T Express, Ninja Van, DHL etc…

This ate into their margins, in a business where every cent counts. In 2018, Shopee launched SPX, but it was only really the last 2-3 years where they ramped up investments into their proprietary logistics business.

This has been a game changer, with SPX being the 2nd largest player in the market, behind J&T Express.

Conclusion:

This has been yet another solid quarter by Sea Limited, something we shareholders have seemed to get used to.

Management clearly understands what it has to do to optimise growth and profits for all 3 businesses, after years of iteration.

As always, a reminder that my thesis for Sea Limited is decades-long. This is a business that I believe is critical digital infrastructure for Southeast Asians, and will remain so for decades to come.

I believe it will be Southeast Asia’s first ever trillion dollar business. The primary thesis being a demographic tailwind, supported by a brilliant, technical and experienced management team.

Until the next earnings call, thank you for reading!

Important News:

Over the past 9 months, I’ve published 25 articles ranging from deep dives, earnings reviews, to newsletters, all made available for free. In parallel, I’ve also shared over 1,100 posts on X, consistently offering insights and commentary.

This work has required hundreds of hours of effort, and I’m truly grateful that many of you have found it valuable.

As you know, this remains a passion project I pursue outside of my full-time commitments. As such, it’s not sustainable at the current level of depth and frequency without additional support.

Looking ahead, I’m exploring the introduction of a paid subscription tier. To be clear, the majority of content will continue to be free and accessible to all.

However, paid subscribers will gain access to premium breakdowns, occasional exclusive posts, portfolio performance updates, and the opportunity for one-on-one conversations.

I haven’t set a launch date yet — I want to be certain I can deliver on the value promised.

If you have thoughts or feedback, I’d love to hear from you. Feel free to reply here or reach out to me directly on X, my DMs are always open.

-GabGrowth

Company continues to deliver! Pre-earnings my PT was $190 and I still think this company can deliver my discount rate of 12%.

My two cents on premium substacks which I feel is over-saturated, copy the Hims House model. Focus on one company (maybe two SE and GRAB), and become the absolute best resource for retail investors for that company to the point that as a shareholder of the company, I'd be silly not to have. That is the only substack I have subscribed too. They report on every press-release, do interviews, maintain models and predictions, etc.

I agree with DK, the risk however is that at some point neither business survives which seems unlikely with Grab and Sea but maybe with Hims? We don’t know. I pay the equivalent of a Bloomberg sub with private money across the substacks I subscribe to and so think there are too many premium substacks too