Around 9 months ago, my first ever Substack post was a deep dive on Sea Limited:

Since that post, Sea Limited stock is up 97.99%. Yet, I believe the business remains a compelling investment today for the long-term investor.

Sea Limited is the largest position in my portfolio and the stock which I have the most conviction in. I hope you will be able to see why through this deep dive. Enjoy!

Table of Contents

Introduction

Company History

Company Overview

Industry and Market Analysis

Competitive Analysis

Bull Thesis

GabGrowth Quality Score

Risks

Financials

Ownership

Valuation

Concluding Thoughts (What I am personally doing)

1. Introduction

Sea Limited is Southeast Asia’s leading internet powerhouse. A conglomerate that spans e-commerce (Shopee), digital financial services (Monee), and gaming (Garena). Founded in 2009 and based in Singapore, Sea has grown from a pure game publisher into the region’s dominant online marketplace and a major financial-services provider.

Throughout its history, Sea has repeatedly reinvented itself: from Garena into Shopee and Monee, and most recently, from hyper growth to disciplined, profitable execution.

Today, Sea Limited is:

Southeast Asia’s Leading E-Commerce Platform

One of the Largest Financial Service Providers in the Region

A Resurgent Gaming Publisher with the Most Popular Mobile Game in the World

I believe Sea has the potential to be the first trillion dollar company in Southeast Asia.

2. Company History

Like many great companies, understanding the full journey of Sea Limited provides important context for the business it has become today. Its history plays a key role in grasping the company’s current structure and in building confidence in its leadership. Hence, I will start by walking through the company’s origins and how it has evolved to this point.

2009-2014: Inception, The Garena Years

Sea’s story began in Singapore in 2009, when Forrest Li, a Stanford MBA graduate born in Tianjin, China, founded Garena. Initially short for “Global Arena”, Garena started out as a game distribution and social platform, bringing hit titles like League of Legends to Southeast Asian gamers. It became the go-to hub for online gaming in the region, known for its local servers and community-first approach.

During these early years, Garena proved adept at operating Western games under localised strategies, forming partnerships with developers like Riot Games and Electronic arts. This allowed Garena to scale fast without building proprietary games.

Tencent Holdings becomes a strategic investor in the early 2010s (eventually owning ~22% pre-IPO), forging a long-term alliance in game distribution.

By 2014, Garena’s valuation reached ~$1B, making it one of Singapore’s first tech unicorns, while The Economist ranked Garena as Singapore’s largest internet company.

2015-2016: Pivot to Sea Limited, the launch of AirPay and Shopee

Seeing the rise of mobile-first consumers in Southeast Asia and taking cues from Alibaba’s success, Sea launched Shopee as a mobile-first C2C platform. Growth was rapid, driven by chat-based UX, social features, integrated payments and logistics. Sea scaled quickly with logistics partnerships, seller tools, and heavy marketing. Within three years, Shopee became the top e-commerce platform in several Southeast Asian markets. Around the same time, Garena began testing a payment service called AirPay, laying the groundwork for Sea’s future fintech arm.

In May 2017, Garena undertook a major corporate rebranding after closing a fresh $550 million funding round. The parent company adopted the name “Sea Limited” (reflecting “Southeast Asia”) to better represent its diverse businesses across digital entertainment, e-commerce, and financial services. The Garena brand was retained solely for the gaming arm. This rebranding signalled to investors that Sea was more than a game publisher; it was beginning to position itself as a consumer internet conglomerate akin to China’s Tencent or Alibaba.

2017: Rebranding, IPO and Early Public Market Days

Sea went public on the NYSE in October 2017, raising $884 million in its IPO, pricing at $15 per share and valuing the business at around $4-5B. Shares debuted under the ticker SE and closed up 8% of the first trading day. At the time, it was one of the largest Southeast Asian tech listings. The capital allowed Sea to double down on Shopee expansion and fund Garena’s internal game development.

Soon after listing, Sea secured a digital banking license in Malaysia and applied for others, reflecting its ambitions in fintech. It also quietly started a fintech investment arm (Sea Capital) to invest in startups. These strategic steps, along with the IPO proceeds, were aimed at funding regional expansion and possibly acquisitions.

It was around this period that Garena launched its first major proprietary game: Free Fire. Initially seen as a low-budget PUBG clone, Free Fire became a surprise global hit, especially in Latin America, Southeast Asia, and India. Its lightweight size, fast-paced gameplay, and localised content proved effective in emerging markets with lower-end phones. Sea’s ability to create original IP (Free Fire) reduced reliance on third-party titles and improved margins in the gaming segment.

2018-2019: Regional Expansion and Content Growth

With Shopee scaling and Garena printing cash, Sea launched SeaMoney to build out financial infrastructure. Originally designed to support Shopee transactions (AirPay), SeaMoney expanded to digital wallets, payment gateways, and micro-loans. It helped address a core issue in the region: millions were shopping online but lacked credit cards.

By 2020, Sea was operating a full-stack ecosystem:

Garena brought users in via gaming

Shopee monetised attention into e-commerce transactions

SeaMoney captured payment volume and financial data

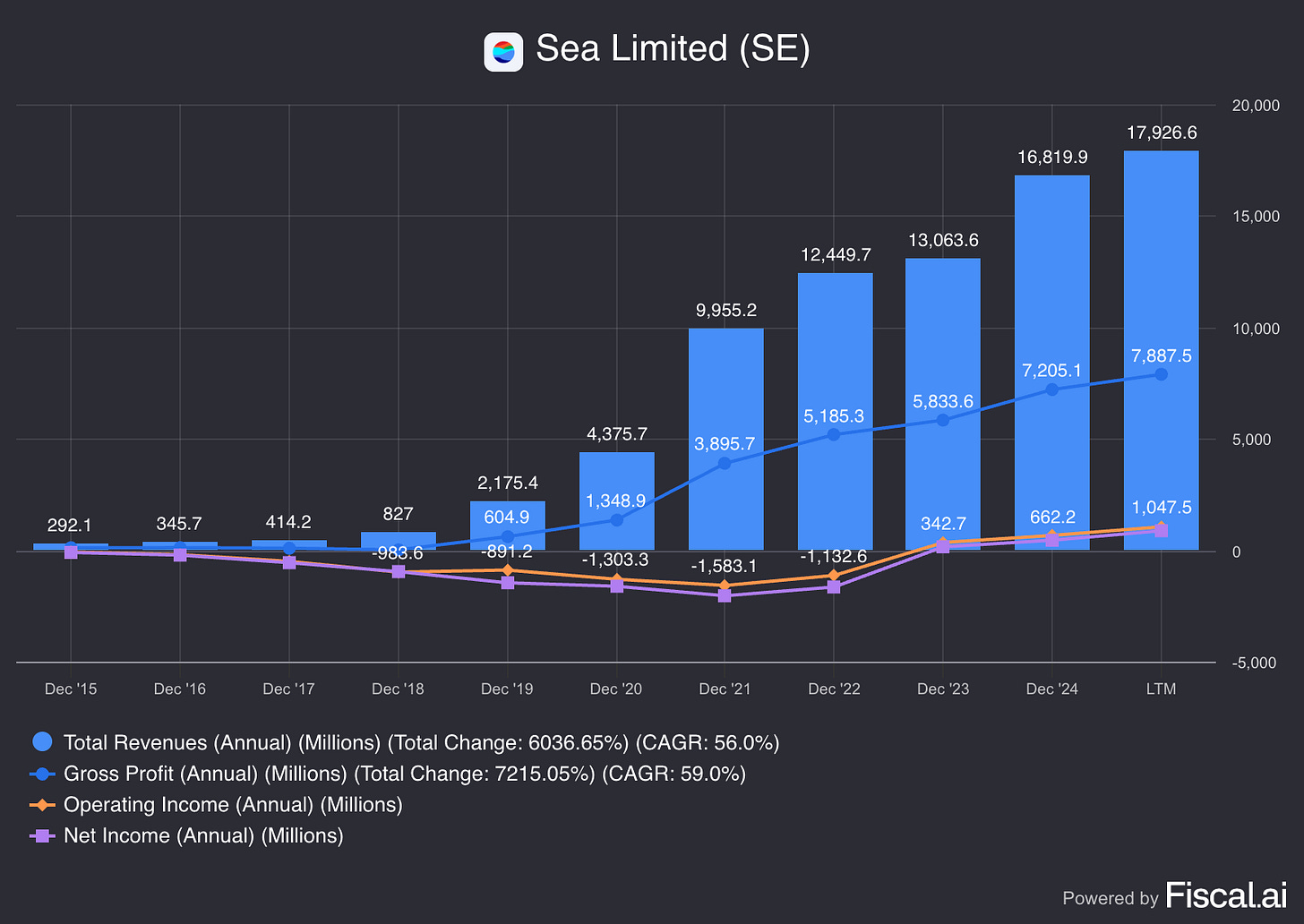

The strategy was working. Revenue grew from $400M in 2017 to $4.3B by 2020. The company raised billions more in follow-on offerings to fund even faster expansion - including into Latin America (Shopee Brazil) and financial services.

Anticipating continual expansion needs, Sea raised additional capital. In March 2019, it announced a $1.5 billion follow-on offering primarily to support Shopee’s growth. Tencent and other major shareholders maintained support.

By the end of 2019, Sea’s balance sheet was fortified with billions in cash, even as it continued investing aggressively in user acquisition. This set the stage for Sea to weather upcoming challenges and seize opportunities during an unforeseen catalyst: the COVID-19 pandemic.

2020-2021: The COVID Boom

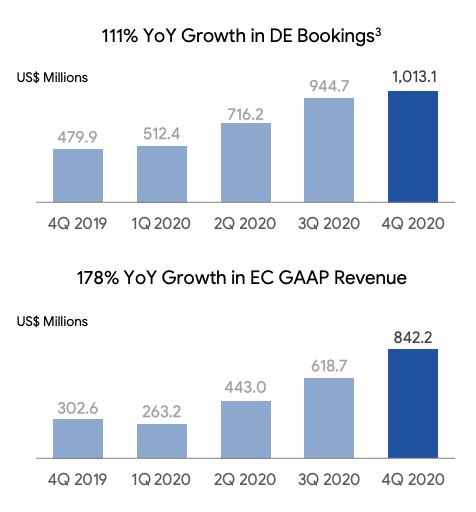

Lockdowns across Southeast Asia in 2020 turbocharged Sea’s growth. Shopee’s GMV soared, becoming the most downloaded app in the region, while Garena’s Free Fire surpassed 100 million daily users, with bookings topping $1B for the year.

Sea’s market cap surged from $15B to over $200B by late 2021, briefly making it Southeast Asia’s most valuable company.

FinTech and Digital Bank Licenses

Sea ramped up SeaMoney, integrating payments into Shopee and launching digital lending. It secured a Digital Full Bank license in Singapore (Dec 2020) and acquired Bank BKE in Indonesia, rebranding it as SeaBank. By late 2021, Sea also obtained a Malaysian digital bank license and was building SeaBank Philippines. FinTech was early-stage but growing fast. SeaMoney’s revenue rose 155% YoY in 2021.

Funding the Expansion

In Sept 2021, Sea raised $6.3B in Southeast Asia’s largest equity offering, bringing cash reserves to $13B. Shares peaked at $372, lifting its valuation past $200B. The raise proved timely ahead of macro headwinds.

Aggressive Global Expansion

Flush with capital, Sea began aggressively expanding Shopee beyond its ASEAN base in 2021. In September, Shopee entered Europe for the first time by launching in Poland, followed shortly by launches in Spain and France. In November, Shopee entered India with a pilot initiative, leveraging Garena’s Free Fire user base to build initial brand awareness.

Around the same period, Shopee expanded further into Latin America, launching cross-border operations in Mexico, Chile, and Colombia. These moves reflected Sea’s broader global strategy, with management identifying market testing as a key use of funds from its 2021 capital raise. By the end of the year, Shopee had a presence in more than a dozen countries worldwide.

Financial Performance and Investor Perception

Shopee hired Ronaldo and other celebrities, reflecting a global brand push, but also a high-burn strategy. In 2021, revenue grew 127% to $10B, but net losses exceeded $1.6B.

This growth-at-all-costs model was accepted during the pandemic, but by late 2021, concerns about sustainability emerged. Still, Sea remained a market darling, seen as a rare mix of Amazon (e-commerce) and Tencent (gaming) in one.

2022: Challenges, Corrections, and Strategic Reset

In early 2022, Tencent cut its stake in Sea by $3B, reducing ownership from 21% to 18.7% amid China’s tech crackdown. The move was seen as de-risking and sent Sea’s stock down 11% in a day. A bigger blow followed in Feb 2022, when India banned Garena’s Free Fire over security concerns tied to Chinese-linked apps. Despite Sea being Singapore-based, its ties to Tencent led to inclusion. Free Fire lost one of its biggest markets overnight, wiping $16B in market value (–18%) in a single day.

In March 2022, Sea withdrew Shopee from India, just five months after launch, citing “global market uncertainties.” Shopee also exited France and Spain by Q2. These moves marked a strategic retreat to core markets, as global ambitions were reined in.

At the same time, Sea’s financial momentum reversed. Shopee’s YoY revenue growth slowed to 21% in Q2 2022 (vs. triple digits in 2021), while Garena’s revenue fell 40%, driven by normalising demand and the India ban. With growth stalling and costs still high, Sea’s aggressive expansion model became unsustainable.

Pivot from Growth to Profitability

In June 2022, CEO Forrest Li announced a pivot from growth to profitability, triggering major cost cuts. Sea froze hiring, slashed marketing, and laid off ~7,000 employees (~10% of its workforce) across Shopee, Garena, and SeaMoney. In September, Li told staff the leadership team would waive salaries and bonuses until the company reached self-sustaining cash flow, calling cost discipline essential to “the company’s survival.” This marked a clear strategic shift, signalling to investors that management was serious about curbing losses.

First Profits Emerge

The austerity measures began to show results by the third quarter of 2022. Operating losses narrowed significantly. In November 2022, Sea reported that Shopee’s Southeast Asia/Taiwan e-commerce business turned adjusted EBITDA positive for the first time in its history. Although on a net basis Sea still lost money in Q3, the company’s commentary projected confidence that the worst was over. Forrest Li announced that self-sufficiency was within reach, emphasising disciplined growth going forward.

Investors reacted very positively; Sea’s stock jumped 36% in a single day after the Q3 results, its biggest ever daily gain, as the market embraced the profitability pivot. This steep rebound followed a prolonged slump: by mid-October 2022 Sea’s share price had cratered to around $40 (down ~85% from peak) amid global tech selloff and Sea’s own cutbacks. The Q3 news marked a partial restoration of investor sentiment, showing that Sea could pull financial levers when needed.

Consolidation and Exits

Sea made the tough call to exit or suspend several non-core initiatives. It discontinued its investment arm (Sea Capital) in 2022, halting new equity investments in startups to conserve cash. Shopee closed its operations in Chile, Colombia, and Mexico in September 2022, reverting to a cross-border model serving those markets from abroad. It also fully exited Argentina. In Europe, Shopee had already pulled out of France and Spain, and by January 2023 it would also shut its Poland marketplace after a year of trials.

Essentially, Sea retrenched to its core: Southeast Asia, Taiwan, and Brazil (the one major overseas market where Shopee maintained local operations given its strong traction there). These retreats, while disappointing for Sea’s global ambitions, were ultimately welcomed by investors as prudent focus. By the end of 2022, Sea’s narrative had shifted from break-neck expansion to one of streamlining and driving toward profitability amid a tougher macroeconomic climate, with rising interest rates and the end of the ZIRP era.

2023: Profitability Achieved and Market Reassessment

Sea posted its first GAAP profit in Q4 2022 and earned $162.7M net income in 2023, driven by cost cuts and stronger monetisation. Shopee’s SEA arm and SeaMoney both turned EBITDA-positive.

However, growth slowed. Q2 2023 revenue rose just 5.2%. In response, Sea re-invested in Shopee, accepting short-term losses to revive momentum.

By Q4 2023, Shopee’s orders surged 46% YoY, and Sea stayed profitable. By Q3 2024, Shopee was profitable in Asia and Brazil. SE shares rebounded to $70–80, as investors regained confidence in Sea’s balanced growth strategy.

Garena Stabilisation

After a rough 2022, Garena stabilised in 2023. Free Fire remained resilient, hitting 100M+ daily active users again by Feb 2024, boosted by new content like a Naruto crossover.

Though revenue stayed below 2021 peaks, Garena continued generating strong EBITDA, funding other Sea segments. With League of Legends rights lost in 2023, Sea is focusing on original IP to reduce reliance on Free Fire. Garena was no longer a growth engine, but remained a profitable, cash-generating core.

2024: A Renewed Business Outlook with Sustained Profitability

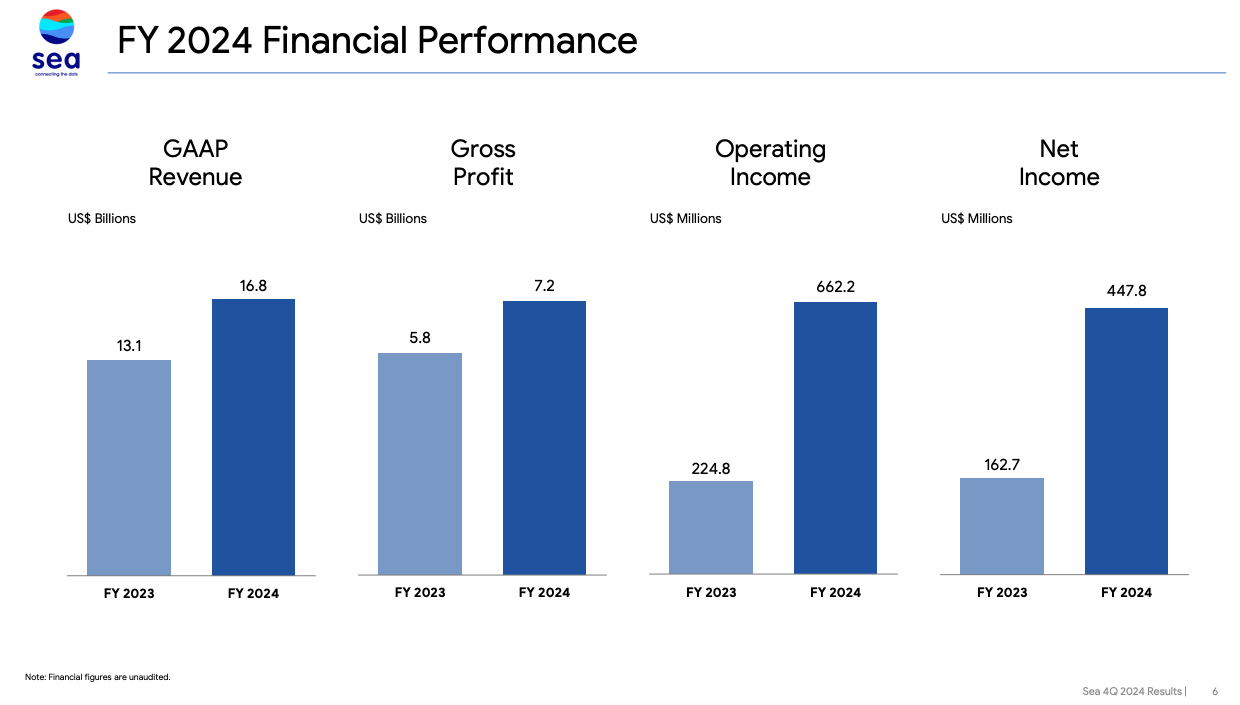

Entering 2024, Sea built on its profitable 2023. In FY24, Sea’s revenue grew ~29% to $16.8 billion and it remained in the black. The business had demonstrated two consecutive years of positive net income, a critical validation of its business model.

Shopee’s dominance in Southeast Asia e-commerce held firm. By mid-2024, Shopee commanded 30–50% of online retail traffic share in key SEA countries and was also the top platform in Taiwan. In Brazil, Shopee’s local marketplace flourished with over 3 million local sellers by 2023 and more than 90% of sales coming from domestic merchants. This local traction helped Shopee Brazil improve unit economics. Investors started to assign value to Sea’s international operations again, seeing Brazil as a potential second pillar (outside SEA) for long-term growth.

Shopee: Finally Profitable

In the third quarter of 2024, Sea announced that Shopee (e-commerce) had achieved profitability at the segment level across Asia and Brazil. Specifically, Shopee recorded an adjusted EBITDA of +$34.4 million in Q3 2024, a stark turnaround from a $346 million loss a year prior. This was a watershed moment – it showed that Shopee can be profitable even as it grows (Q3 e-commerce revenue surged 42.6% YoY). Sea’s stock jumped over 17% on this news, reaching its highest level in over two years.

The company attributed Shopee’s improved margins to operating efficiencies, better monetisation (higher ad revenues and seller commissions), and pulling back from loss-making geographies. By late 2024, Sea had effectively proven its e-commerce business model in its core markets – a key catalyst for investor confidence, since e-commerce is Sea’s largest revenue segment.

2025: Sea Enters Its Profitable Prime

In early 2025, Sea rebranded SeaMoney to Monee, reflecting its push to build a consumer-focused fintech brand. In Q1, Monee’s revenue rose 57% YoY, with $241M in EBITDA, driven by strong adoption of ShopeePay, SPayLater, and SeaBank, which is now profitable across Indonesia and the Philippines.

Sea’s Q1 results beat expectations: $4.8B in revenue, $411M net profit, and growth across all segments. Shopee’s GMV hit $28.6B, maintaining its GMV number from Q4 2024, up 21% YoY.

Most impressively, Garena saw bookings grow 51% YoY and adjusted EBTIDA grow 57% YoY, with QPUs accelerating from ~8.1% average in the last 4 quarters to 9.8% in Q1 2025. QAUs hit an astounding 661.8M with APRU jumping to $12. We are seeing a re-acceleration in Garena’s business and evidence that Free Fire is an evergreen franchise.

As of mid-2025, we are seeing a resurgent Sea Limited, with its 3 core segments firing on all cylinders. It is a lean, profitable machine with a dominant e-commerce business in Southeast Asia, a hugely profitable gaming business and a FinTech business that continues to execute rapidly in a flawless manner.

3. Company Overview

Coupang operates several business lines. For the sake of brevity, we will focus on just 3 key business segments.

Shopee (E-Commerce)

Garena (Digital Entertainment)

Monee (Digital Financial Services)

Shopee (E-Commerce)

Shopee was once the cash-burning growth engine of the company for nearly a decade. Today, it is Sea’s largest revenue contributor by far (~74%) and has turned into a profitable business.

Shopee is Southeast Asia’s largest e-commerce platform, accounting for over 50% market share. It is deeply embedded in the daily lives of consumers across Southeast Asia, Taiwan, and Brazil.

Think of Shopee as the Amazon/Alibaba of Southeast Asia: a marketplace connecting millions of buyers and sellers, enriched with features like Shopee Live, games, and integration with ShopeePay.

Shopee’s product mix is broad, skewing towards low-cost goods (fashion, beauty, electronics accessories), although in recent years, it has also begun to dominate higher-ticket items through Shopee Mall where top quality brands sell their products.

A key part of its success has been the investment by management into its logistics business: SPX Express, which is now the 2nd largest logistics player in Southeast Asia. It was integral in handling 3.1 billion orders in Q1 2025.

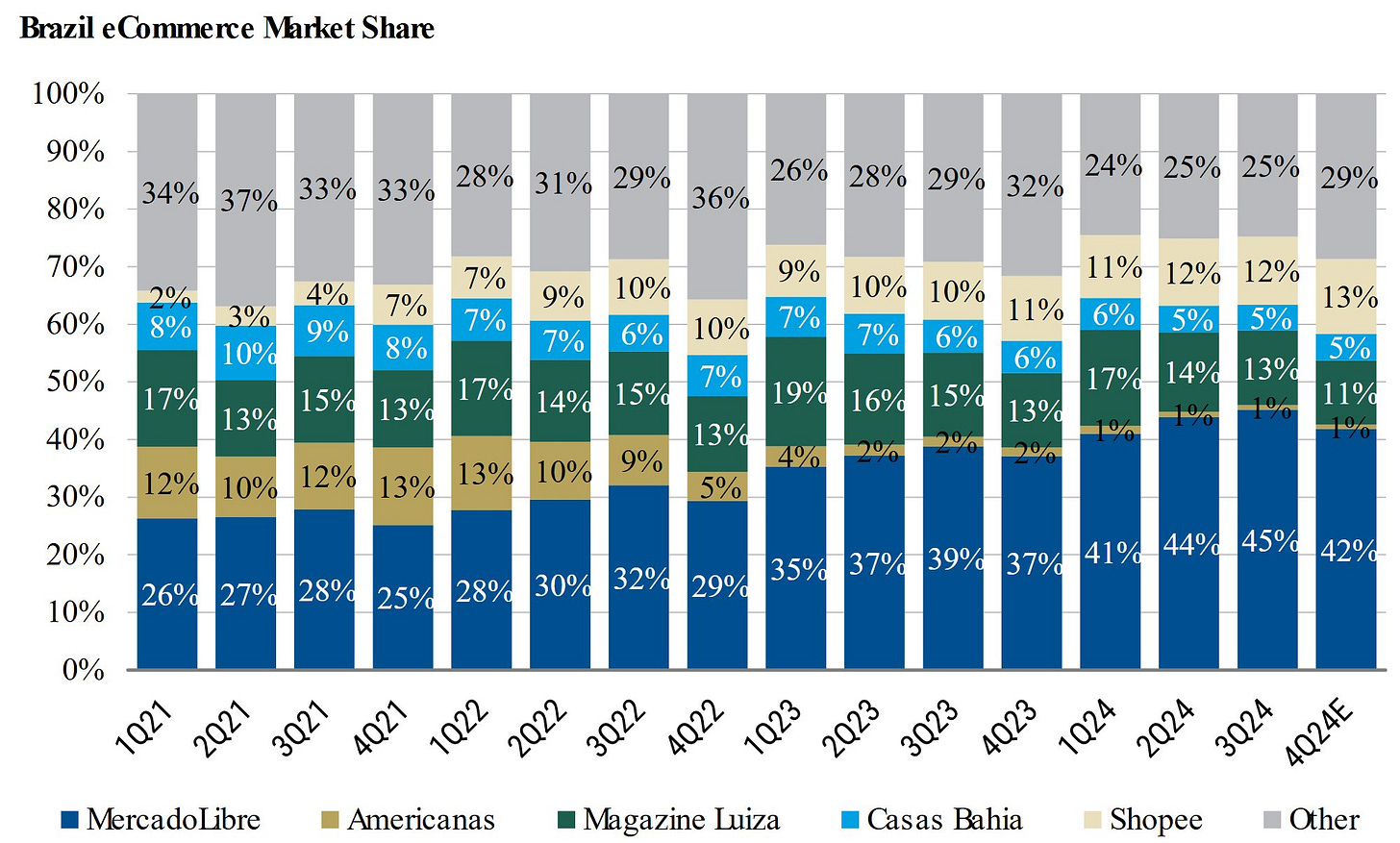

Southeast Asia and Taiwan remain Shopee’s stronghold, but its recent success in Brazil will play a key part in the growth story. In 2024, Shopee was the 3rd largest online marketplace in Brazil with an estimated $15B GMV, ~15% market share.

Shopee now operates as the:

E-Commerce Leader in Southeast Asia and Taiwan

Digital Payments Enabler via ShopeePay and SPayLater

Logistics Integrator with in-house and third-party delivery support

Ad Platform for Sellers and Brands

Local Marketplace Operator in Brazil, its largest market outside Asia

Garena (Digital Entertainment)

Garena was the original core of Sea’s business and the company’s first success. While Garena is no longer the primary growth driver (~11% of Revenue), it remains a vital part of Sea’s ecosystem as it brings in a disproportionate share of earnings due to its huge margins.

Its crown jewel, Free Fire, continues to be the dominant driver for Garena, and has proven to be an evergreen franchise going into its 8th year.

On top of Free Fire, new titles like Delta Force Mobile and Garena Free City show the company is actively building its next portfolio, attempting to reduce its reliance on a single franchise.

Today, Garena operates as:

A game developer and publisher, focused on high-engagement mobile titles

A cash generator for the group, with consistently high EBITDA margins

A content IP incubator, developing its own titles like Free Fire Max, Free Fire India, and upcoming releases like Free City

A platform for e-sports and community engagement, with frequent in-game events, crossovers (e.g. Naruto), and large regional tournaments

Monee (Digital Financial Services)

Monee, formerly known as SeaMoney, started as an embedded payments solution within the Shopee ecosystem.

Initially viewed as a supporting utility, it has since evolved into one of Sea’s fastest-growing segments, with services spanning mobile wallets, consumer credit, and digital banking across Southeast Asia.

Monee’s growth has been explosive. In Q1 2025, Sea’s digital financial services segment generated $787M in revenue, making up ~16% of revenues and achieved $241M in adjusted EBITDA (a healthy ~30% EBITDA margin).

With operations in 8 SEA markets + Brazil, Monee is among the largest digital financial services providers in the region, giving Sea an entry into the lucrative world of payments and banking.

Today, Monee consists of 3 core services:

Payments:

ShopeePay is Monee’s mobile wallet that provides users with a fast and secure way to make online payments, transfer funds, and pay offline at thousands of merchant partner locations

Financing:

SPayLater is Monee’s consumer financing solution that provides BNPL services to users, also allowing for splitting purchases into instalments

Banking:

SeaBank (ID, PH): Digital Bank that offers savings accounts, transfers, and consumer loans

MariBank (SG): Digital Bank that helps users transact, manage finances securely and offer attractive interest rates with no minimum balance

In aggregate, these three businesses make Sea a diversified digital internet giant. Sea’s mission statement “to better the lives of consumers and small businesses with technology” manifests in Shopee empowering small merchants selling online, Garena connecting gamers, and Monee providing financial access to the underbanked.

Geographically, Sea’s core focus is Southeast Asia. But it also has one foot in Latin America (through Brazil). As of 2025, Sea employs over 80,000 people across its divisions. The synergy between businesses is a notable aspect with Garena’s Free Fire helping Sea Limited to acquire users at low costs, Shopee’s platform driving adoption of Sea’s payment services, and Monee’s loans fuelling more Shopee transactions — a flywheel that management hopes will strengthen Sea’s competitive moat over time.

4. Industry and Market Analysis

Sea Limited operates at the intersection of several massive, high-growth industries, along with the tailwind of operating in huge emerging markets. I believe understanding the tailwinds (and headwinds) in each domain and geography is crucial for evaluating the company’s prospects.

E-Commerce in Southeast Asia:

SEA’s e-commerce market has been on a tear over the last decade, powered by rising internet penetration, a young population, and rapidly improving logistics networks.

The median age in Southeast Asia is just 33, with a growing middle-class that will be a strong tailwind for e-commerce, not just because of rising disposable incomes, but also due to changing consumption habits.

As this demographic becomes more digitally savvy and convenience-oriented, they are increasingly turning to online platforms for shopping, payments, and services → making them a key driver of long-term growth.

Consumer behaviour in SEA is notably mobile-first and social media-influenced. Unlike Western markets where Amazon dominates, SEA consumers often shop on marketplaces and social platforms.

SEA’s e-commerce GMV is expected to double from $149B in 2024 to $300B in 2029. This implies ~15% CAGR over the next 5 years.

Markets such as Indonesia, Vietnam, and the Philippines are still in the early stages of e-commerce maturity, offering significant runway for growth as logistics networks improve and digital trust builds.

E-Commerce in Latin America:

Latin America is an emerging e-commerce powerhouse, with extremely strong logistics networks built by the likes of Mercado Libre.

Online retail sales penetration is expected to skyrocket in the coming years, which will be a huge tailwind for the sector in the region.

Digital Payments and FinTech in Southeast Asia:

Southeast Asia is a FinTech goldmine, a region where a large portion of the population is underbanked or unbanked, yet nearly everyone has a smartphone.

In markets like Indonesia, cash is still used on delivery for many e-commerce orders, although digital wallet adoption is rising quickly.

~60% of Southeast Asia’s adult population remain unbanked while 85% remain underbanked, creating fertile ground and an immense opportunity for digital financial services to thrive.

Fintech in the region spans payments, lending, insurance, and increasingly, wealth and investment products.

Mobile wallets have become deeply embedded in everyday transactions, especially in urban centers, driven by QR code adoption, government cashless initiatives, and tight platform integrations with transport and retail ecosystems.

The shift toward embedded finance, where payments, BNPL, and micro-loans are natively offered within consumer platforms, is transforming user expectations.

Regulators across Indonesia, the Philippines, and Singapore have granted digital banking licenses, further legitimising fintech players and opening new lanes for product expansion.

As trust in digital financial products deepens, opportunities to cross-sell services and monetise engagement are growing, especially among SMEs and the younger, digitally native demographic.

Gaming & Digital Entertainment in Southeast Asia:

Southeast Asia is one of the world’s most engaged gaming markets, with over 250 million gamers and some of the highest mobile gaming penetration globally.

More than 80% of Southeast Asia’s urban online population plays online games. Developers are actively implementing social elements, especially in mobile games, which account for ~72% of total video game revenue in the region.

Mobile games dominate, driven by affordable smartphones, widespread 4G access, and cultural affinity toward competitive, multiplayer experiences.

Indonesia, Thailand, and Vietnam are particularly vibrant markets, both in user base and in local developer ecosystems.

Gaming is no longer just a leisure activity but a deeply social medium. The rise of free-to-play titles with in-game purchases, esports events, and influencer-driven game marketing have contributed to strong monetisation per user, especially in tier-one cities.

5. Competitive Analysis

Sea Limited’s competitive landscape spans different arenas for each business unit.

E-Commerce Competition:

Southeast Asia

This has been the main competitive battleground for Sea Limited. Shopee’s rise to dominance in Southeast Asia came largely at the expense of Alibaba’s Lazada, which entered the region earlier (Founded in 2012, bought by Alibaba in 2016).

TikTok Shop has seen incredible success in recent years, with 4x growth in revenue in 2023 through its novel blend of entertainment with impulse shopping. Recognising this, Shopee has doubled down on its own live-streaming and short-video features through forming a partnership with YouTube.

In September 2024, YouTube teamed up with Shopee to launch YouTube Shopping in Indonesia, Thailand, and Vietnam. This tie-up allowed YouTube viewers to directly purchase items features in videos via links to Shopee, effectively marrying YouTube’s 300M+ strong Southeast Asian audience with Shopee’s vast e-commerce fulfilment network.

Early signs are promising:

YouTube users are 98% more likely to trust creators' product recommendations than those on other social platforms

Purchase intent is 3.8x higher on YouTube than other social platforms

Southeast Asia now accounts for 2/3 of YouTube Shopping's global rollout

In Thailand, L' Oreal combined its YouTube campaign with Shopee affiliate links and recorded 10x more high-intent views, while halving its cost-per-visit

8 in 10 Gen Z consumers in SEA prefer shopping that includes entertainment

Latin America (Brazil, for now)

In Latin America, Shopee currently competes only in Brazil. In Brazil, the dominant player in e-commerce is without a doubt, Mercado Libre. However, it is generally a much more fragmented market than Southeast Asia with multiple smaller players.

Shopee has experienced tremendous expansion in Brazil, growing its market share ~6.5x over the past 4 years. Its growth strategy has focused on offering affordable products, often sourced from Chinese sellers, and engaging users through gamified promotions with free giveaways.

Additionally, Shopee has also developed its own logistics arm, SPX Express, in the country, and is beginning to benefit from economies of scale. In Q1 2025, the average cost per order fell by approximately 21% YoY.

To counter this, Mercado Libre recently took on a new pricing strategy, slashing minimum purchase for free shipping from R$79 to R$19. Brazil accounts for over half of Mercado Libre’s revenue, and rivals such as Shopee and Temu have been rapidly gaining share in the past year through selling lower-priced goods.

Shopee’s competitive moat in e-commerce rests on its scale and user engagement. It has the most app downloads and time-in-app among SEA shopping apps, indicating a strong and loyal user base. It also has a network of millions of small sellers that create a breadth of product offerings that are hard to match.

Shopee has also built significant logistics capabilities (fulfilment centers, Shopee Xpress delivery) and last-mile partnerships across the regions, which are a huge deterrence for new entrants.

Digital Entertainment & Gaming Competition:

In gaming, Garena’s competition is two-fold: other game companies vying for players’ time and money, and the underlying risk of its own content pipeline.

Free Fire competes in the battle royale genre primarily against Krafton’s PUBG Mobile and BGMI (the India-specific variant of PUBG Mobile). Globally, Free Fire carved a niche by targeting emerging markets and lower-end devices, whereas PUBG Mobile aimed for slightly higher-end markets and was nearly banned in some countries (like India, though BGMI returned). With Free Fire banned in India (due to data sovereignty concerns regarding Sea’s partial Chinese ownership), Garena lost a key growth market in 2022.

Another key competitor is Tencent Games, a subsidiary of their largest investor, Tencent. Tencent is also a distributor of PUBG Mobile and has multiple highly successful games such as Honor of Kings, League of Legends, and Valorant (the latter two are from its ownership of Riot Games)

Tencent has in-house development, publishing, and social platforms (WeChat, QQ) that create a sticky ecosystem. However, their dominance is largely in China, where Free Fire does not operate. Hence, while it is no doubt a strong player, it is not entirely a direct rival to Garena.

Moonton, owned by ByteDance (TikTok’s parent company), owns Mobile Legends: Bang Bang (MLBB), a dominant Multiplayer Online Battle Arena (MOBA) game across Southeast Asia, particularly in Indonesia and the Philippines. While it operates in a different genre from Free Fire, it remains a strong competitor for gamers’ attention.

Free Fire’s brand equity remains extremely strong in Southeast Asia, and Brazil, with its deep localisation efforts, aggressive community building, and strong product market fit, core to the success of the game, going into its 9th year of operations.

In Q1 2025, Free Fire’s Quarterly Paying User ratio rose to 9.8%, up from 8.2% a year prior, indicating its ability to continue monetising more effectively. It continues to see over 100M daily active users.

Digital Financial Services Competition:

The Financial Services/FinTech space is arguably the most competitive with several hundred well-funded competitors.

Payments

In the payments space, nearly every major tech player offers an e-wallet: Grab with GrabPay, GoTo with GoPay, Sea with ShopeePay, as well as standalone FinTech unicorns such as DANA (owned by Ant Financial), OVO (also owned by Grab), Akulaku, Credivo etc…

ShopeePay has an edge, being embedded in the most used shopping app, giving it a large active user base transacting on e-commerce. It frequently ranks among the top digital wallets in SEA by transaction volume. However, rivals such as Grab, for instance, can drive adoption of GrabPay through its ride-hailing and food delivery services, a different use case that keeps users transacting daily.

There is also significant overlap in these services. For example, a typical young customer in Jakarta, Indonesia might use ShopeePay for online shopping, GrabPay for rides and food, and GoPay for other bills — meaning competition is about increasing “wallet share” and becoming the default Super App wallet.

Lending and Digital Banking

Sea faces competition from new digital banks and incumbents that are adjusting to the digital era. For example, Grab-Singtel obtained a digital bank license in Singapore and launched GXS Bank in 2022 targeting youth and gig workers. In Indonesia, GoTo acquired Bank Jago, integrating it with its services. Traditional banks such as DBS and BCA are rolling out better mobile banking apps too.

GrabFin and Monee have a key rivalry here, especially in lending, with both offering BNPL and personal loans. GFin leverages Grab’s ride data to underwrite loans, while Sea leverages Shopee’s shopping data. These offline transactions are high-frequency that keep users tied to their payment ecosystem. So far, Monee’s loan book ($5.8B) is an order of magnitude larger than Grab ($566M), although that could change in future.

In Brazil, Monee faces well-funded players such as Nubank and MercadoPago. Nubank is arguably the most formidable digital finance player in Brazil with over 100 million customers, offering digital bank accounts, personal loans, insurance, investment services, credit/debit cards. Mercado Pago is the FinTech arm of Mercado Libre, offering robust e-commerce wallets, QR payments, credit, instalment financing among other services. Mercado Libre being the largest e-commerce player in Latin America, will be a tough opponent for Monee. However, similar to Southeast Asia, the Latin American digital financial services market is one that has enough room for multiple winners.

6. Bull Thesis

The bullish investment thesis for Sea Limited centers on the company’s dominant market positions, multiple growth drivers, improving profitability, and visionary leadership.

E-Commerce Leadership in High Growth & Emerging Markets

Shopee is the undisputed leader in Southeast Asian e-commerce, a region with enormous growth runway ahead. Shopee has entrenched itself as the go-to platform for online shopping. At ~$100B annual GMV, it is larger than all the other competitors combined in SEA while it continues to gain market share in key markets.

In fact, Shopee is the most dominant e-commerce business in the world, measured by its market share percentage of GMV in SEA, which stands at roughly 62%. In contrast, although Mercado Libre, Alibaba, and Amazon are often perceived, and valued, as stronger leaders, they each control only about 35-45% of their regional markets.

This leadership position creates network effects: millions of sellers and small businesses are dependent on Shopee to reach customers and fulfil orders. Meanwhile, shoppers know Shopee is where they can find the greatest variety and deals. This creates an uphill battle for new entrants, forming a moat for Shopee.

Garena’s Second Wind: A Cash-Rich Growth Engine

Free Fire remains the world’s largest mobile game by average DAUs and downloads. This dominance has continued into its 9th year of operations despite claims that Free Fire would be a one-hit wonder. Free Fire’s focus on lower-spec requirements, targeting users from less developed countries with cheaper mobile phones have been a huge success and continues to earn them market share. Meanwhile, Free Fire MAX, its higher-spec version has also seen incredible success in similar markets.

Free Fire is back, firing on all cylinders again. Quarterly Active Users are at 3 year highs, with the Quarterly Paying Users ratio accelerating in the recent quarter. Bookings and EBITDA grew by 51% and 57% YoY respectively. This resurgence is more than a short-term bump. Garena has kept user engagement high through relentless collaborations with popular themes such as NARUTO SHIPPUDEN in Q1 2025.

Garena has continued to work on newer games to diversify its revenue streams: Garena Free City and Delta Force Mobile have seen huge traction in its first few months of release. If any one hits half of Free Fire’s scale, Garena’s aggregate bookings could double without new infrastructure required.

Monee: FinTech Flywheel with Huge Runway

ShopeePay/Monee now handles one in every three online transactions across Indonesia, Thailand and Vietnam, eclipsing GrabPay, GoPay and all local wallets. Dual QR and NFC support has pushed Monee into 550,000+ offline merchants, making it the de-facto cashless standard used by people everyday.

Loans Principal Outstanding grew over 75% YoY in Q1 2025, while adding over 4 million first-time borrowers. Consumer and SME loans active users grew over 50% YoY, exceeding 28 million. Despite this massive growth, Monee’s Non-Performing Loans ratio further decreased to just 1.1%.

A $6B consumer/SME loan book still represents ~2% of Shopee’s total GMV, yet it already brings in ~$1B in annualised EBITDA at a 30% margin. Embedded data from Shopee and Garena such as SKU-level spending, repayment cadence, BNPL, Free Fire top-up behaviour drives a strong proprietary credit scoring system. This has likely been instrumental in allowing Sea to undercut banks’ default rates by up to 40 basis points.

Sea also holds full digital bank charters in Singapore, Indonesia, and the Philippines, and is a front-runner in Malaysia. These take years and millions to secure; new challengers will arrive long after Monee has locked in deposits, network effects and embedded itself into the habits of consumers.

Integrated Flywheel Effect (Shopee + Garena + Monee)

At the core of Sea Limited is the flywheel effect that is so crucial to the business’ success. It starts with Shopee, the region’s dominant e-commerce marketplace. By dangling ultra-low prices, free-shipping vouchers, and splashy “9.9” or “11.11” campaigns, Shopee pulls in the broadest possible top-of-funnel traffic.

At checkout, Shopee nudges those buyers toward Monee’s wallet or buy-now-pay-later option. Each successful payment locks in low-cost deposits for Monee while collating granular transaction data that sharpens its credit-scoring models.

The richer the data, the more confidently Monee can underwrite micro-loans, insurance policies, or robo-advisory products, monetising the same user a second time and at margins far higher than core commerce.

Garena then keeps those users engaged for free. Its flagship game Free Fire pushes daily log-ins, esports events, and collectible skins that cost nothing for Sea to market because Shopee banners and Monee push-notifications do the promoting.

Crucially, data from commerce, payments, and gaming flows into a unified targeting engine. That feedback loop lets Shopee serve more relevant ads, Monee price credit more precisely, and Garena fine-tune in-game offers, lifting gross profit across the board.

A dollar spent on Shopee vouchers thus ripples through to Monee fees and Garena top-ups, lowering blended acquisition costs and funding the next round of subsidies or content drops. The result is a flywheel of traffic, data, and monetisation that compounds over time and is exceptionally hard for stand-alone rivals to replicate.

Profitability Inflection: Margins Set to Compound

Sea Limited has improved its marketing efficiency massively over the last few years. SG&A have come down from 48% of Revenue in 2021 to just 27% in 2024. Blended gross margin continues to rise, now at 44%, driven by higher take rates, fintech yield and digital goods mix.

Sea’s operating leverage is just beginning. Every 1 point rise in Shopee’s ad-driven take rate produces ~$1.2B in annualised gross profit (for context, this is more than Garena’s entire 2024 EBIT).

Sea is currently at the inflection point of profitability, with net income margins below 5% in the LTM. All 3 segments reached profitability for the first time in Q1 2025. With no particular segment to drag down profit margins, we will likely see a huge profit inflection over the next few years.

My favourite stocks to buy are those sitting at the inflection point of turning profitable. This moment often triggers a powerful re-rating over the next 1-2 years.

This is because most analysts cover too many names to fully grasp the nuances of each business. Before profitability, they rely on crude metrics like EV/EBITDA or price-to-sales, which rarely reflect the true upside of high-operating-leverage models. Once a company crosses into profitability, the market starts valuing it through entirely different lenses; P/E, PEG, DCF, often leading to substantial revisions in price targets.

Investors who understand the company’s underlying economics: its cost structure, scalability, and reinvestment potential can position early, ahead of the shift. This sets up asymmetric payoffs: fundamentals improve, and multiples re-rate. These setups are rare and depend on finding high-quality businesses with meaningful operating leverage. I believe Sea Limited is one of them.

Visionary Founder-Led Execution

Forrest Li comes across as quiet, even shy, but beneath that calm exterior lies a fierce competitor. His story is often overlooked, but this is a man who since launching Garena in 2009, has repeatedly spotted huge opportunities and made bold pivots.

Firstly, turning a single game-publishing licence into the region’s dominant esports platform, then pivoting to mobile commerce with Shopee just as smartphone adoption exploded, and finally embedding payments and credit through Monee to close the transaction loop.

When the 2022 tech sell-off led to a 90% stock sell-off, huge losses for Shopee and a major decline in profitability for Garena, Li tore up his own playbook, cutting his salary to US$1, exited low-ROI geographies, and steered Sea to its first full-year profit within 18 months.

I believe he is one of the few tech founders in Southeast Asia who is truly generational, and at 55, he has a decade or two ahead of him. I have no worries with him at the helm.

Funny story about Forrest Li shared by the media years ago:

During a family vacation, Forrest asked his daughter what she missed most about home. Taobao, the popular Chinese online shopping platform, owned by Alibaba was her answer. Li joked back: "Okay then, Daddy will build one for you." Apparently, he wasn’t joking.

Upside Optionality and New Avenues for Growth

Sea’s core businesses are already printing cash, in spades. However, a key reason for my interest in Sea is the optionality layered on top. Sea has several call options.

Firstly, Shopee’s ad business is far from maturity. Ad take rate as of FY24 was ~3%. In comparison, Amazon and Mercado Libre’s sit north of 7%. This is low-hanging fruit that Sea will easily grab in the coming decade, leading to ~$5B in incremental gross profit.

Secondly, Sea is seeding new growth vectors. Shopee is increasingly looking to dominate the live/social commerce space through its YouTube-Shopee integration. On the Monee side, micro-insurance, robo-advisory, and other FinTech products can swiftly monetise Sea’s 28 million active borrowers. Shopee Xpress (SPX) also recently opened its fulfilment network to third party brands, effectively turning its logistics CAPEX into a fee-based business. Meanwhile, Garena’s IP could make for interesting franchising opportunities. A pipeline of new games are among the other call options for the business.

Demographic & Macro Tailwinds

Southeast Asia and Brazil supply Sea Limited with a structural growth runway that most developed market peers can only envy. ASEAN’s total GDP is projected to surpass $5T by 2030. Southeast Asia also remains home to one of the youngest populations in the world, with a median age of ~33. The growing middle class, mobile-native cohort is entering into its prime consumption and credit-borrowing years exactly as Sea’s flywheel reaches scale.

While 80M new internet users came online in the COVID years, and with internet penetration rates over 82%, 85% of SEA remain underbanked. This is a huge opportunity for Monee and they are in prime position to capture it.

Meanwhile, Brazil logged $276B in digital transaction volume in 2023 and is on track to exceed $500B by 2026. Rising disposable incomes, modern payment rails, and an ongoing 5G rollout expand Sea’s total addressable market, even before discussing Sea entering other countries in Latin America.

7. GabGrowth Quality Score

As some of you may know, this is one of the key tools I utilise in evaluating businesses. You can view my full methodology below:

Sea scored 17.5/20 for my Quality Score checklist, making it a “Best-in-Class” business. It scored full marks on all but 3 metrics:

“Contrarian but Right”

Sea Limited was a contrarian choice in the $40 range, where I pounded the table on the stock. Today, at ~$150, I would argue it is a consensus, if not slightly overlooked business. Therefore, I would not give it any points.

“Recurring or Sticky Revenue”

I gave Sea half a point here, instead of the full point. While Shopee, Garena, and Monee are arguably sticky businesses with recurring revenue streams as a result of user behaviour, these revenue streams are not guaranteed.

I reserve full marks only for high quality software as a service type businesses, businesses that have strong customer lock in, retention or subscription-related business models. Perhaps Sea Limited gets there one day.

“Sustainable Competitive Advantage”

I gave Sea Limited 1 out of 2 points here. While Sea has undoubtedly built a moat through its flywheel, and huge merchant plus user base, e-commerce, gaming and financial services are largely still commodity businesses with little moat. I believe this could change with time, but have decided to cut a point here for Sea.

Overall, 17.5/20 is an extremely respectable score, one that ranks it alongside the likes of Microsoft (18/20), Nvidia (17.5/20), Amazon (17/20).

8. Risks

Right, enough of the good stuff. Let’s dive into the risks that Sea faces.

Competition Risk

Competition is arguably the most immediate risk to Sea’s business, as it has been for the best part of 10 years. In Vietnam, Shopee’s share slid from 68% to 62% in Q1 2025 while TikTok Shop jumped from 23% to 35% of GMV in the same quarter. Across Southeast Asia, the combined TikTok Shop - Tokopedia entity commands ~28% share (compared to Shopee’s 62%).

Continued growth by the combined entity or a resurgent Lazada could pressure margins, and result in a never-ending price war, one that has had disastrous consequences over the past decade.

In Digital Financial Services, there is no shortage of competition. Well funded players such as GrabFin, GoTo, Ant Financial will be leveraging their ecosystems to chip away at Monee’s growth. For instance, they could bundle financial services with their core products/services. However, I believe this is an area where there is space for several large winners.

In Gaming, a hot new game from a competitor could draw large swaths of players, and their wallets, away from Free Fire. The fickle nature of gaming means Garena’s revenues could be volatile if a competitor’s title goes viral.

If Sea fails to keep up with other competitors’ product offerings, its user engagement could drop. We saw what happened the last time it did in 2021/2022. This risk is somewhat mitigated by Sea’s incredible growing scale, but remains a constant threat.

Execution & Operational Risk

Sea now juggles nine core e-commerce markets, a cross-border FinTech stack, Brazil expansion, and a global gaming franchise, all while under single digit group EBIT margins.

Mis-steps, such as warehouse bottlenecks, failed roll outs, could snowball and pressure margins. Operational risk also includes talent retention: Sea’s success thus far has been driven by strong teams in each market. High turnover or the inability to attract top talent could slow innovation in the business. (This is also true for current employees who have made enough over the past 15 years and might choose to retire or step away)

Garena has been the most cyclical of Sea’s 3 key segments, and was arguably the main contributor for the dramatic 90% drawdown in 2021/2022. While the business has seen picked up spectacularly, being a singular-title business certainly has its risks.

Macroeconomic & Political Risk

Sea is heavily influenced by macroeconomic conditions in its key markets. Many Southeast Asian economies (and Brazil) are emerging markets, which are prone to higher volatility. Consumer spending could slow if inflation rises or if we see another economic downturn, which would directly hit Shopee’s GMV growth and Monee’s payment volume.

These geographies also carry meaningful political and regulatory risk that can change the trajectory of Sea’s business overnight. These could include banning of social-commerce (affecting Shopee), capping of interest rates (affecting Monee), limiting game time (affecting Garena).

Growth Sustainability in Latin America

As Shopee continues prioritising profitability, it may scale back marketing and buyer incentives in Brazil, potentially slowing its growth momentum there.

This comes at a time when Mercado Libre has strengthened its competitive position by offering free shipping on items over 19 Brazilian reais (~$3.40), which covers more than 80% of its listings. Going forward, Sea will need to carefully navigate the trade-off between sustaining growth and maintaining profitability, something it has (to its credit) managed with discipline in recent years.

Key Man Risk

Forrest Li has been the key man over the past 16 years. As we’ve seen recently with Marcos Galperin at Mercado Libre, there will come a time when they decide to step away. A sudden departure could jolt investor confidence or worse, have a material impact on the future trajectory of the business.

Personally, I believe Sea Limited has the perfect man to replace Forrest Li: Chris Feng. Prior to joining Sea Limited, Chris worked at Rocket Internet SE, Zalora, Lazada, and at McKinsey & Company. He joined the company in March 2014 as Head of Mobile Business at Garena before serving as the CEO of Shopee from July 2015, spearheading the business to dominance. He also took up the CEO role of Monee from March 2020 concurrently. He has served as President since January 2022. At just 42, he is 13 years’ Forrest’s junior and would be a capable successor.

Chris Feng has also typically led earnings call responses due to his fluency in English compared to the rest of the management team.

9. Financials

Sea Limited’s financials have shifted dramatically in the past decade. From a cash-burning business, it is now a self-funded compounder.

Every revenue and profitability metric is trending up and to the right, and I believe we are exactly at the point of profitability inflection.

In FY2024, Sea limited generated $16.8B in GAAP revenue growing at 28.8% YoY, $7.2B in gross profit and $447M in net income with adjusted EBITDA nearly doubling to $2B.

This strong performance continued into Q1 2025. The business made $411M in net income, nearly the entire FY 2024’s net income number in just one quarter.

E-Commerce (Shopee):

GMV held steady quarter on quarter, an amazing feat considering cyclicality. Adjusted EBITDA expanded massively to 0.9% of GMV.

Despite being at over $100B annual GMV, Shopee’s average monthly active buyers grew by over 15% YoY in Q1 2025.

Ad revenues continued to grow rapidly, at over 50% YoY in Q1 2025. This was largely attributed to number of sellers who spent on ad products and average ad spend that increased by 22% YoY and 28% YoY respectively.

On the cost end of things, Shopee’s investment in logistics continued to pay dividends, with cost-per-order reduced by 6% and 21% YoY in Asia and Brazil respectively.

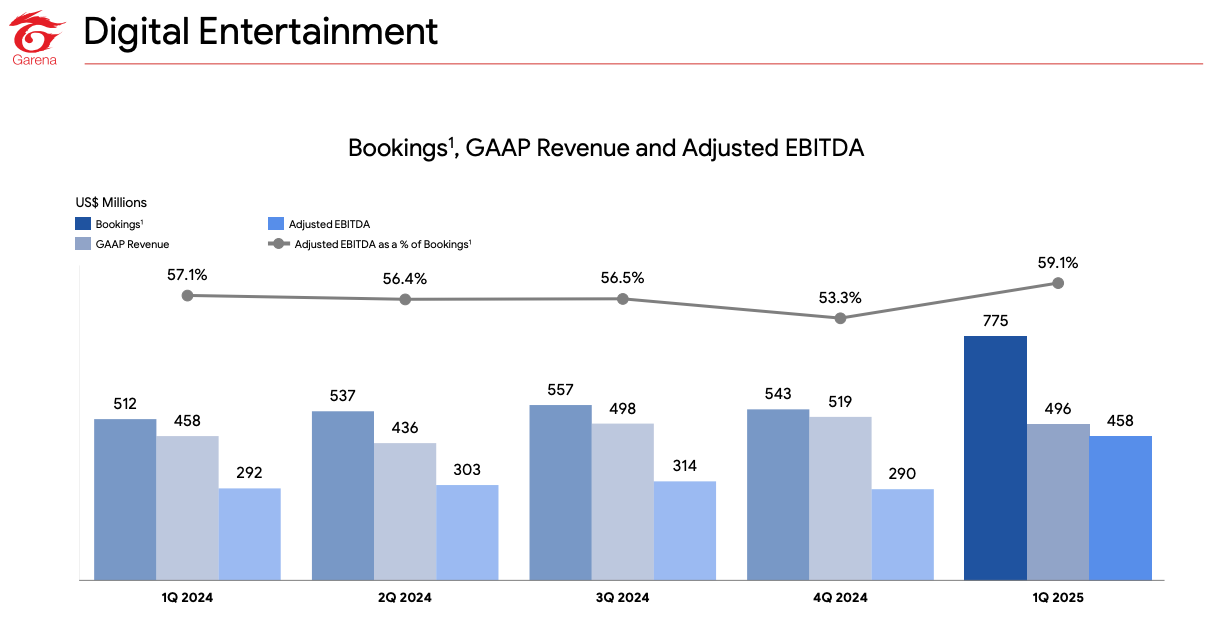

Digital Entertainment (Garena):

Garena had its best quarterly performance since 2021; total bookings grew 51% YoY and adjusted EBITDA grew 57% YoY in Q1 2025.

Quarterly Paying Users saw a huge spike from 8.2% in Q4 2024 to 9.8% in Q1 2025. Average Revenue Per Paying User also saw a huge spike to $12.

Free Fire’s collaboration with NARUTO SHIPPUDEN was the key contributor as average DAUs in Q1 2025 was close to peak quarterly average DAUs during the pandemic.

Free Fire continues to be the world’s largest mobile game by average DAU and downloads.

Digital Financial Services (Monee):

Monee has continued its incredible growth with LPOs growing over 75% YoY in Q1 2025 while NPL90+ ratio remained stable at 1.1%.

Of note, Off-Shopee usage of SPayLater has grown meaningfully, now accounting for over 10% of the market’s loan book. This is a key development and one that bodes well for the reduced reliance on Shopee.

Monee’s EBITDA margin is now at a whopping 30% while revenue continues to grow over 57% YoY.

Cash Flow Statement and Balance Sheet:

Operating Cash Flows were comfortably positive as of Q1 2024 with the business bringing in $3.56B in the TTM. Free Cash Flows were also strong, at $3.25B in the TTM, equating to a 18% margin.

Liquidity is also robust with Sea’s gross cash sitting at $10.3B. Against that, balance sheet leverage is modest, Sea retired 1% 2024 converts and now carries just $2.63B of convertible note obligations (2.375% 2025s and 0.25% 2026s) and bank borrowings of $380M. That leaves Sea with a net cash position of ~$7B.

Sea also holds $2.7B in customer deposits through Monee, giving them access to a cheap, sticky funding source that lowers overall cost of capital for the business. CAPEX is relatively light at $318M, running at under 2% of revenue.

10. Ownership & Management

Sea’s management is among the longest tenured and most experienced of any business I’ve personally come across.

Sea was founded by Forrest Li, Gang Ye, and David Chen, all of whom remain at the business till today. Forrest maintains his position as Chairman and CEO of the business. Gang Ye served as the CTO between 2010 to 2016 before transitioning to the COO role, a position he has held since 2017. David Chen served as the COO between 2010 to 2016, before transitioning to a Chief of Staff role between 2017 and 2019, before moving again to serve as the Chief Product Officer of Shopee.

The other 4 key personnel are Tony Hou, who joined Sea in 2010 and has served as the CFO since 2013, Chris Feng who I mentioned previously, Terry Zhao who joined Sea at inception and has served as President of Garena since 2018, and finally Yanjun Wang, who joined Sea in 2014 and has served as the Chief Corporate Officer since 2019.

Ownership Stakes:

Forrest Li owns 17.8% of the business today, a sizeable stake and the vast majority of his net wealth. Impressively, since the IPO, Forrest has held onto all his stock, apart from a measly 140,000 planned share sale in end 2021. Those sales accounted for approximately 0.12% of his total share count.

Fellow co-founders Gang Ye and David Chen own 5.1% and 2% of the stock respectively. Of note, Chris Feng owns 1.6% if the total outstanding shares.

This demonstrates significant skin in the game and is a strong positive for me as a shareholder.

Sea’s single largest corporate holder remains Tencent, that owns ~17.6% of the business.

Voting Rights:

There are generally two camps in this thinking. Firstly, people who believe no one should have majority voting rights. Secondly, people who think founders and decision makers deserve to have majority voting rights. I am firmly in camp 2, for visionary founder CEOs.

That is exactly the case here. Forrest Li owns 59.1% of total voting rights, thanks to the 15x power that each Class B stock owns.

Tencent owns 8.5%, while other insiders own a total of 2.2% The rest are owned by institutions and retail.

With majority voting rights, Forrest Li doesn’t have to compromise long-term strategy for short-term optics. These same rights were likely instrumental in allowing him to pivot the business from pure gaming to e-commerce in 2015, pour billions into logistics, flip the business into austerity mode in 2022, a move that has now proven to be absolutely the right move.

Importantly, the alignment of interest is economic too. No one suffers more than Forrest Li from a drawdown in the stock.

11. Valuation

My preferred way to value Sea Limited is a sum-of-the-parts model. Each of the group’s three pillars — e-commerce, gaming, and financial services — operates in a distinct industry with its own growth curve, margin structure, and peer multiple. Treating them separately surfaces value that a single blended multiple would bury.

Shopee:

I have decided to split Shopee into two separate buckets: (1) Core E-Commerce & Logistics, (2) Ads & Value-Added Services, because each bucket has a completely different set of economic drivers, risk profiles and public-market reference points.

Shopee (Core E-Commerce & Logistics)

Shopee’s FY24 GMV hit $100.5B with management expecting 20%+ growth in FY25. To be conservative, I assume just 20% growth, forecasting $120B in GMV for FY25.

Shopee’s core business take rate (ex-ads) came in at 9% last year. Shopee is clearly in the take rate expansion phase but to be conservative, I stuck to a 9% take rate here too.

Stripping out the large variable costs such as shipping subsidies, courier payments and buyer-protection fees, I think it is fair to conservatively assume just 30% of that is gross profit. Post-austerity, marketing, customer support, product & admin head-count etc, now runs ~20% of revenue.

That leaves us with an EBIT margin of ~10%. For reference, the likes of Mercado Libre are between 11% to 14%.

A 9% take rate paired with a 10% EBIT margin gives us roughly 0.9% of GMV:

$120B x 0.9% = $1.08B in EBIT

Mercado Libre’s e-commerce engine trades at 15-17x EV/EBIT while Alibaba’s domestic retail runs at 12-14x EV/EBIT. I decided to split the difference at 15x EV/EBIT.

$1.08B x 15 = $16.2B EV

Shopee (Ads & Value-Added Services)

I believe the large majority of Shopee’s future value potential rests in its digital advertising business and that has largely been overlooked. Amazon will be the key focus of comparison here. Currently, Amazon converts roughly 5% of its GMV into digital ad sales with 55%+ FCF margins.

Assuming a very conservative 2% conversion of Sea’s projected $120B GMV, it would generate approx. $1.32B in FCF from advertising alone in 2024. Applying a conservative 35x EV/FCF multiple, Shopee would be valued at $46.2B EV.

Before you ask, I would like to justify the 35x EV/FCF multiple. Firstly, the SEA digital ad market is nascent and is at least a decade behind the US market. The US market is projected to grow at double-digit rates from 2024 to 2028, implying significant room for growth for the SEA digital ad market.

This is further supported by SEA’s sustained high single-digit GDP growth forecast. Using Amazon's digital advertising business, which achieves 55%+ FCF margins, as a blueprint, Sea's stronger market position suggests similar or better potential. Additionally, the valuation doesn't factor in Sea's competitive advantage from its established shipping and logistics infrastructure.

Garena:

Garena grew its bookings at 51% YoY in Q1 2025 and adjusted EBITDA 57% YoY while management guided for a full year double-digit growth in bookings.

Comparable companies such as EA and Take-Two typically trade at 20-30x NTM EV/FCF multiples while growing at slower rates than Garena.

EA currently trades at 18x NTM EV/FCF with negative revenue growth in FY24.

Take-Two currently has negative EBIT but trades at 27x EV/EBIT while expected to grow revenues at mid single-digit rates.

To be extra conservative, I would take an estimate of a 25x EV/FCF multiple. Adjusted EBITDA for Garena came in at $458M in Q1 2025, up from $290M in Q4 2024. It is possible that this was a one-time bump, and hence I would stick to $300M and annualise that number, giving us $1.2B Adjusted EBITDA for FY25.

Assuming Adjusted EBITDA = FCF owing to the fact CAPEX is minimal in this business, we arrive at $1.2B x 25 = $30B EV

Monee:

Finally Monee, with its growing user base in largely unbanked/underbanked demographics, has significant growth potential.

It brought in ~$1B in annualised adjusted EBITDA as of Q1 2025, a very impressive feat and one that seems to be overlooked by the market at the moment. Assuming a 80% EBIT/EBITDA conversion, that would put annualised EBIT at $800M.

I believe the most similar peers in the industry that can be compared to Monee include Adyen, Nu Holdings, and PayPal. Currently, Adyen trades at roughly 40x EV/EBIT, Nu Holdings trades at roughly 20-25x EV/EBIT, while PayPal trades at roughly 15-20x EV/EBIT while.

Assuming a low to mid-range estimate of 20x EV/EBIT, Monee would be worth approximately $16B EV.

SOTP:

A SOTP would therefore imply a combined Enterprise Value for Sea Limited of:

Shopee (Core E-Commerce & Logistics): $16.2B

Shopee (Ads & VAS): $46.2B

Garena: $30B

Monee: $16B

In total = $108.4B

Adding net cash of ~$7B, we arrive at a final EV of $115.4B or $195. At today’s price ($153), that gives us an upside of around 27%. I believe this is a very conservative base case valuation and I could see a future where Sea massively outperforms these assumptions.

That said, with Sea Limited stock up 48% YTD and 104% in the past year, I must urge caution for all investors who are considering an entry.

12. Concluding Thoughts (What I am personally doing)

This final section is for paid subscribers, where I will be sharing my personal thoughts on where I see the business heading in the coming year and decade.

If you have been considering an upgrade to the paid subscription tier, now would be the ideal time. In the past 2 weeks, I have posted 6 articles of which several included paid-only sections. The feedback from paid subscribers so far has been incredible, I truly appreciate it.

Starting 1st July 2025, I will be officially launching the paid subscription tier where subscribers will get access to:

Full Deep Dive Articles (Min. 1 per month)

Access to Portfolio Performance & Holdings (Once a month)

Monthly SEA Updates (Grab and Sea Limited-specific)

Full Archive of Articles (38 and counting)

Chat with the Community

For free subscribers, rest assured that I am committed to providing majority of the content for free, with the additional content for investors who are looking for more in-depth analysis and my personal thoughts on how things may pan out.

Disclaimer: I am long Sea Limited. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.