Grab reported Q4 2024 and FY2024 Earnings on 19th Feb 2025

Revenue beat while EPS was in line

Stock was down 10% AH due to missed guidance

Contents

Q4 2024 Results v Estimates

Deliveries & Mobility

GFin, Financial Services

Key Earnings Report & Call Highlights

The Good, The Bad, The Ugly

Personal Thoughts

Q4 2024 Results v Estimates

Revenue $764M (+17% YoY) vs. $757M est. ✅

GAAP EPS $0.00 vs. $0.00 est. 🟡

Adj. EBITDA $97M vs. $98M est. 🟡 (ATH)

Revenue Guidance $3.33B to $3.4B vs. $3.39B est. 🟡

EBITDA Guidance $455M vs. $489M est. 🔴

On-Demand GMV $5B (+20% YoY) ✅

Operating Cash Flow $852M ✅

Adj. FCF $136M ✅

Stock closed -10% AH 🔴

Commentary:

Grab beat internal and consensus revenue estimates

Net Profit came in-line

Revenue & EBITDA Guidance missed, but were management sandbagging?

Key Points:

On-Demand GMV re-accelerated with growth of 16% YoY, or 19% YoY on a constant currency basis to $18.364B. This was largely driven by growth in Mobility and Deliveries.

Notably, Deliveries GMV growth accelerated to 13% YoY, or 16% YoY on a constant currency basis, in comparison to the 4% YoY growth recorded in 2023.

Group Adj. EBITDA for the FY2024 was $313M, an increase compared to -$33M in 2023, achieving the upper end of management’s $308M-$313M guidance.

Operating Cash Flow was $852M in 2024, up from just $86M the year before, with improvement driven primarily by a $371M reduction in loss and an increase in customer deposits in the GFin business.

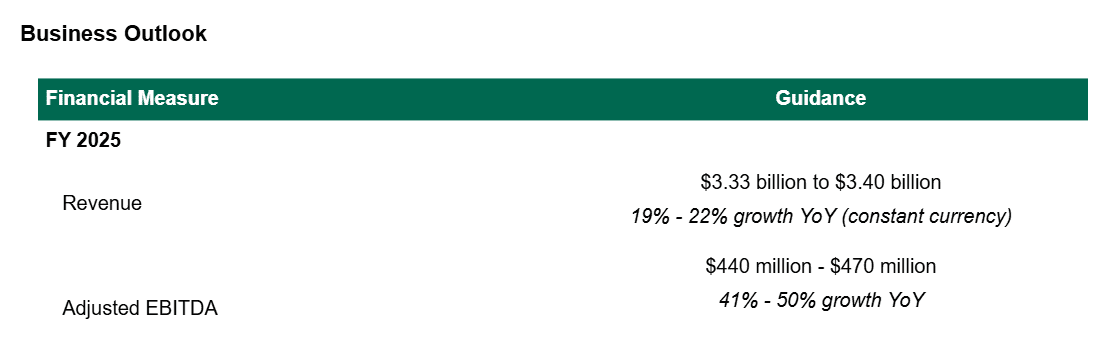

Management guided between $3.33B to $3.4B for Revenue. Consensus Estimates were for $3.39B in Revenue.

Considering management’s consistent sandbagging of numbers, we can consider this to be a beat in Revenue Guidance.

Adjusted EBITDA guidance was $440M to $470M, compared to $313M this year, a 41-50% growth YoY. Street was expecting $489M, a 56% growth.

I am expecting this to be a sandbag too, with management eventually hitting the street’s consensus numbers.

Overall, I think the numbers were good. The business continues to grow at ~20% YoY with a similar expectation next year, in-line with my expectations I set out in my Grab thesis.

Deliveries & Mobility

For both Deliveries and Mobility, GMV grew at a faster rate than revenue, which I thought was slightly concerning. Segment Adj. EBITDA also fell in both business lines.

GMV growing faster than revenue means that Grab’s take rate fell YoY. This reflects poorly on Grab’s pricing power and moat. It is likely that there have been new strong competitors that have resulted in tighter margins. However, this is not a surprise, considering that it has been a very competitive space for almost a decade now.

GFin, Financial Services

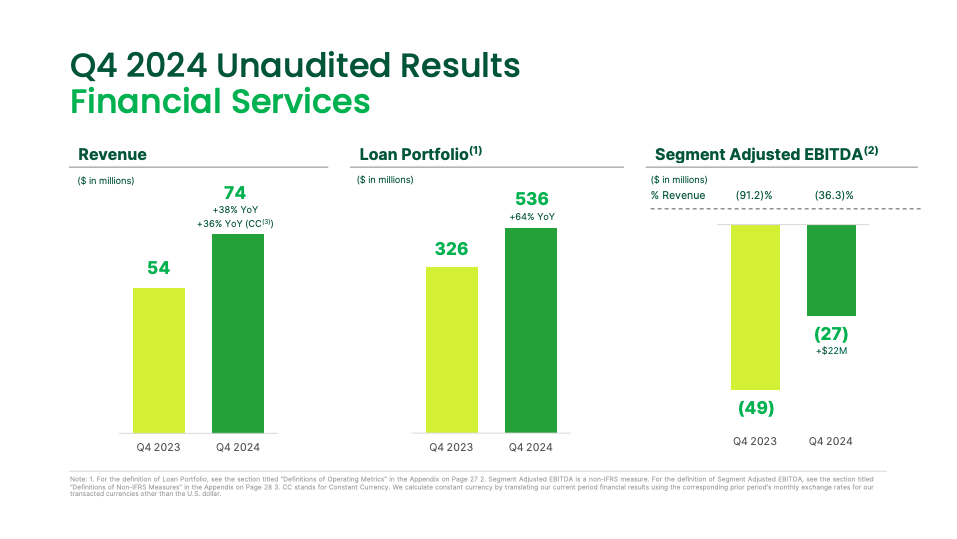

Financial Services Revenue grew by 38% YoY with the loan portfolio expanding 64% YoY. Segment Adj. EBITDA margin fell from -91.2% to -36.3%.

All good signs on the GFin side. Personally, I would like to see faster growth on revenue and loan portfolio but i suspect the limiting factor has been regulations by the respective governments. In November 2024, Grab and Sea, both Digital Full Bank operators in Singapore, attempted to lobby for an increase in the deposit cap. With Grab proving its ability to operate well and safely, it is simply a matter of time before restrictions are relaxed, and perhaps we see faster growth rates.

Key Earnings Call Highlights:

On GFin:

“Flexi Loans in Malaysia just launched in November 2024, mSME products for small businesses also just launched in Malaysia and Singapore.

Financial Services overall will be profitable by the second half of 2026. DigiBanks will be profitable by Q4 2026. GFin side is providing returns comfortably over Grab’s own cost of capital.”

Again, I think management is sandbagging on Fin Services profitability. I believe we could see profitability as soon as end of this year or 1H 2026 which would be a huge boost to the top-line.

One of the key factors I look at when investing in businesses, is looking at business that are turning the corner on profitability. These businesses tend to be overlooked by analysts and misunderstood by all. The inflection point between growth and profitability is often complicated, as none of the traditional financial metrics fit the bill. In the beginning, the business will have extremely high PE ratios and low revenue growth rates, like we do for Grab now. However, as profit begins to optimise, we start to see extremely fast EPS growth, leading to multiple expansion for these businesses.

On the Addressable Market in SEA:

“There is plenty of headroom to drive organic growth in SEA, in mobility, food, and groceries. The addressable market is still significantly under tapped, proven by 44M MTUs so far that is still just serving only 1 in 20 Southeast Asians.”

This is a large part of the Grab thesis. 70% of Southeast Asians remain unbanked/underbanked. GFin could be a key beneficiary of this. As smartphone penetration rates, literacy rates, etc.. increase, it could lead to a huge influx of a new middle-class that will primarily be using Grab’s services in their everyday life.

On Possible Autonomy Disruption:

“On Autonomous Vehicles, we’ve been watching this space closely and are very excited about the long-term opportunity related to this tech. We believe we are in prime position to support the AV transition over the next few years and we have a very significant role to play in this region via a hybrid AV-human fleet.”

These comments were particularly interesting considering the common consensus among investors that Southeast Asian roads were not suitable for autonomy. My view on this is that autonomy will be a slow and controlled roll-out process, perhaps starting in more developed and organised cities like Singapore, Kuala Lumpur, and Penang. I do not expect this to have a material impact on the business’ top or bottom line for the next 3-4 years.

On $GOTO Merger Rumours & Capital Allocation:

“Organic growth comes first in the business and that’s to drive EBITDA growth and free cash flow. Second is having a high bar on M&A activity. These opportunities we evaluate on a case by case basis, but the bar is very high.

We have to make sure that key synergies and value add is instrumental in these inorganic opportunities. Thirdly, there is excess capital. As a priority, we will return it to our shareholders.”

I think this is enough proof that $GRAB had talks with $GOTO and perhaps are weighing up the opportunity. They essentially refused to deny the rumours and skirted around the matter. Here are my thoughts regarding a potential merger.

On the Competitive Landscape in the Mobility Segment:

“I can confirm that we remain the competitive choice leader for mobility across all our markets. Overall across the region we maintained or grew our competitive position. We are the only multi vertical competitor across all markets in the region. That gives us cross-sell benefits, scale benefits, and allows us to continue to invest in some of the new technology like AI where we can amortise those costs across a much larger user base.”

It’s good to hear that Grab’s market share has essentially grown across all regions in mobility despite increased competition. It is only a matter of time before the weaker competitors fall out of the race, imo.

Grab needs to stay the course, introduce newer product/service categories to squeeze out competitors while maintaining or improving margins.

The Good, The Bad and The Ugly:

The Good:

Grab continues to perform well despite a competitive environment, particularly with 20% on-demand GMV growth and accelerating revenue in 2025.

Plenty of headroom for growth in Southeast Asia and management is experimenting with various ways to grow MTUs.

7th consecutive quarter of MTU growth, +17% YoY. This is a great sign considering the SEA mobility business is likely growing at a single digit %.

Management bought back 10.2m shares this quarter for an aggregate amount of $37.1M. This equates to $3.63, management certainly got a great deal.

Saver transport rides created ecosystem uplifts (+26% penetration, drove 14% of new MTUs onto the platform and 1.5x higher average transaction frequency). This shows management’s ability to use various levers to drive MTU growth.

Regional Corporate Costs continued to fall (-12% YoY) despite growing revenue in all 3 segments. This is a sign of prudence by management, something I really appreciate.

The Bad:

Management bought back just 10.2m shares. Grab has now completed $274M of its $500M share buyback program. Personally I was hoping for a larger buyback program or a plan for using the large cash stockpile.

This cash pile has now grown to a whopping $6.1B in cash liquidity (31% of market cap in cash!)

The Ugly:

Consumer Incentives were up 37% YoY in Q4 while On-Demand GMVs were up just 20%. This is simply unsustainable and is a sign of the business’ weak moat. This metric will have to be watched closely in coming quarters.

Thankfully, this number is up 20% YoY in FY24, which is a good sign. Partner Incentives were also up only 11% YoY in FY24.

Personal Thoughts:

It’s been quite a crazy week for Grab with the stock going viral on X over last weekend. For those who have been along the ride prior to the hype, you should remember what your thesis for buying was.

Personally, I bought in at $3.13 last year, averaging up along the way. My average is now in the high $3 range. I plan to add should there be a dip below $4.50.

My thesis for Grab remains; revenue growth, higher for longer. I expect Grab to grow at ~20% for the next decade or so with minor fluctuations along the way. I believe this will set Grab on a path towards being a FCF machine with GFin acting as the growth engine fuelling a rise in net profitability.

Southeast Asia is still in the early innings of growth. There remains two decades of growth at ~5% which would allow the likes of Grab and Sea Limited to grow at 2-3x the rate. 70% of the underbanked/unbanked population will be banked by the aforementioned names.

For those who are here for the long-term, this earnings should be satisfactory and a sign that the business is moving in the right direction. If you are in the stock hoping to make over 5x in a couple of years, this is not the right stock.

Until the next earnings call, thank you for reading!

Disclaimer: I am long Grab. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.