Why it is still undervalued

Why I predict 20% growth for a decade to come

GFin, the ultimate profit machine?

Contents

Overview

Q3 2024 Results v Estimates

Deliveries

Mobility

GFin

Key Earnings Highlights

Risks

Personal Thoughts

Overview

Triple Beat + Raise

Company has raised revenue targets for FY 2024 to 17-18% growth and roughly 11$ Adj.EBITDA Margin

Grab has 42M MTUs, which Grab management estimates to be just 5% of SEA population

Grab is 4x larger than its nearest competitor, virtual monopoly about to earn monopoly profits

SuperApp Thesis: GFin will ultimately accrue the lion’s share of profits as a result of mobility and deliveries funnelling consumers to the platform.

Risks involved include: Incentives and GMV per MTU

Q3 2024 Results v Estimates

Revenue: $716M v $700M est.

Adj. EBITDA: $90M v $69.3M est.

EPS: $0.01 v -$0.01 est.

Stock closed +11.64% on earnings day.

Deliveries

Deliveries revenue grew 13% YoY, 16% on a constant currency basis to reach $380M for Q3 2024. GMV grew at a similar rate to $2.965B. Segment Adjusted EBITDA margin grew from 1.3% in the prior year period to 1.8%, a 60% YoY growth.

Important to note that Deliveries has had an ACCELERATION of GMV from 14% in the prior quarter to 16% this Q.

Advertising is also a key area that $GRAB uses to monetise its deliveries. The percentage of Deliveries GMV has increased from 1.4% in the prior quarter to 1.6% in Q3, up from 1.1% in the prior year period. Management mentioned that this is driven mainly be self-serve advertising capabilities, with Grab working to allow merchants to target on platform and have a good understanding of the results. They have done this by introducing cost per order advertising, rather than the traditional cost per click which may be slightly too sophisticated for local merchants.

Management targets 4%+ long term EBITDA margins for mobility. The current EBITDA margin of 1.8% suggests further upside from here.

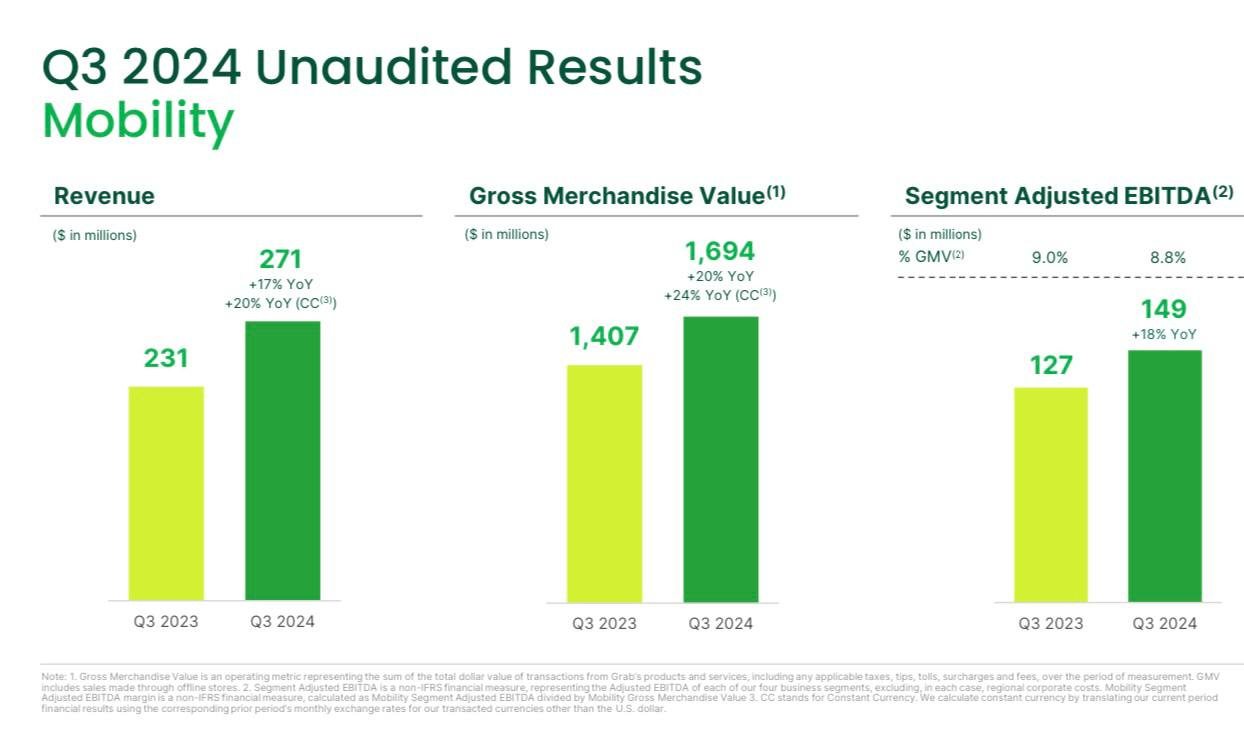

Mobility

Mobility revenue came in at $271M for the quarter, a 17% YoY growth rate, 20% on a constant currency basis.

GMV came in at $1.694B, 20% YoY growth rate and 24% on a constant currency basis.

Segment Adjusted EBITDA grew from $127M in Q3 2023 to $149M in Q3 2024, showing a 18% YoY growth rate.

Management made the point to acknowledge that while there are new entrants entering from time to time, Grab is aware of it and is currently 4x larger than their nearest competitor, likely Gojek.

As noted by management, returns to scale to the largest player is always present in platform businesses such as mobility and deliveries.

In particular, Grab is focusing on high-value mobility rides which has seen 30% YoY GMV growth.

Management has always been long term EBITDA margins of around 9%+ for Mobility which is not far from where it is at the moment. This is one of the many reasons why I view GFin as the next major segment for revenue and profitability growth.

GFin

This is a segment that gets many people understandably very excited about. After all, 4% to 9% EBITDA Margins doesn’t exactly sound amazing. GFin, however, is an extremely capital efficient business that could promise substantial double digit EBITDA margins.

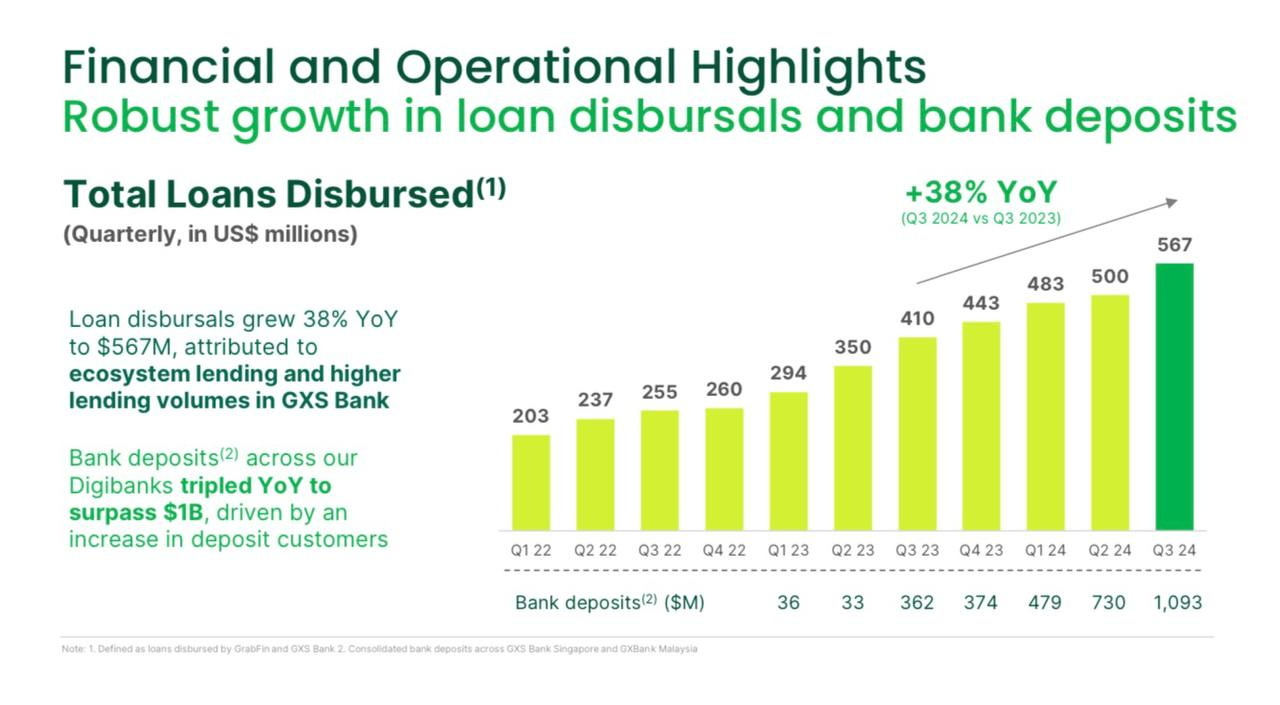

GFin continued to see very huge gains in both revenue and its loan portfolio. Revenue grew 34% YoY (38% on CC basis) to $64M while the loan portfolio expanded 81% YoY to $498M. Segment Adjusted EBITDA shrank massively from -74.7% in Q3 2023 to -40.4% in Q3 2024.

Total loans disbursed grew 38% YoY attributed largely to ecosystem lending and higher lending volumes in GXS Bank. Bank deposits across Grab’s DigiBanks tripled YoY to surpass $1B, driven by an increase in deposit customers.

What interested me most was the insights shared by Grab’s management during the call. Grab has started lending through the banks. Of note, 2/3 of SEA population are either unbanked or underbanked.

Grab targets existing platform users, be it merchants, partners, or users. This results in extremely low cost of distribution. The users have a strong affinity with the brand leading to a positive experience and Grab has a lot of data on them.

Think about it, Grab knows:

-> Whether they commute to work

-> How they commute to work

-> What their spending habits are

-> What they’re doing on PayLater

-> Where they live

Using this info, Grab can then decide whether to lend, how much to lend and what the expected payback period would be.

The first lending product released is the FlexiLoan product that has a NPS of 65. This is huge considering banks typically have a NPS of around 0. The NPL ratio is still around 2% despite significant growth, which shows the prudence of management.

This is a segment that is key to watch in the years to come as growth rates mean it inevitably catches up with the other 2 segments of Grab’s conglomerate business.

Key Earnings Highlights

1. MTUs has recorded its SIXTH sequential quarter of growth, growing 16% YOY to 42M for the quarter.

As i've mentioned repeatedly, this is THE KEY metric to watch for GRAB 0.00%↑ . It is the leading indicator for growth and monetisation ability of the entire company.

Importantly, with SEA being a region of 700M people, of which 60% are under the age of 30, there is tons of room for growth.

2. Cross-Selling Abilities

This is one of GRAB 0.00%↑ 's key moats and an area they MUST focus on. Management is clearly aware of it and has as shown in Q3:

"Cross-Sell of GrabFood users to GrabMart users enabled GrabMart to grow nearly 2x as fast as GrabFood while maintaining profitability. Users of both GrabFood and GrabMart also exhibited average frequency levels that were almost 5X (!!) higher than GrabFood-only users."

Importantly, it also benefits Grab's driver-partners, an equally important but sometimes overlooked aspect: "60% of our two-wheel driver-partners completing both GrabFood and GrabMart transactions recorded 2.5x higher average earnings."

3. FinTech Growth

Loan disbursals grew 38% YOY to $567M and bank deposits TRIPLED to surpass $1B!

FinTech is no doubt an extremely lucrative business and is one of the main reasons Grab as a company interests me. Deliveries and Mobility are the on-ramp for the company but margins are never expected to be high. IMO, FinTech will be responsible for ~80% of the firm's profits in the long run.

Risks

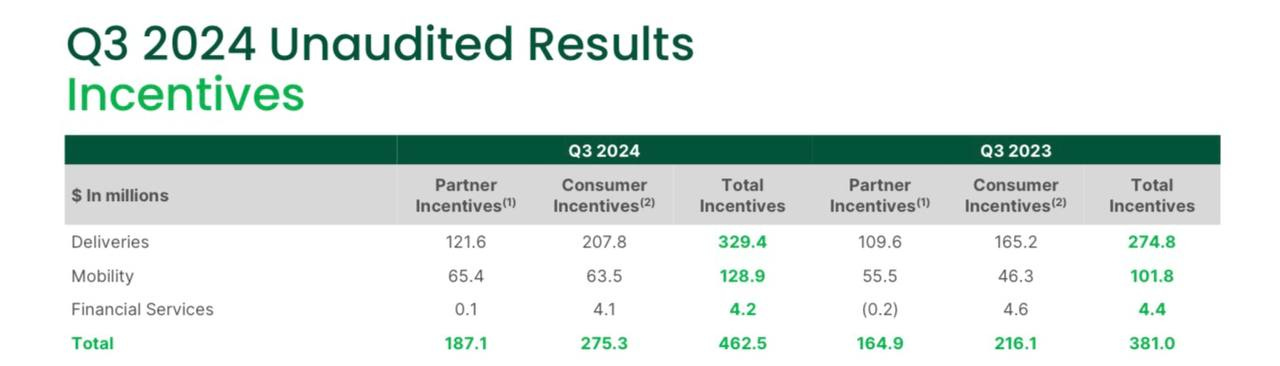

One of the key standouts, in a negative way, was the growth in consumer incentives.

Grab’s consumer incentives grew by 27% YoY, which is substantially higher than the growth in the business, which I believe is rather concerning. Grab’s GMV growth was 16%, so a 27% growth in incentives to consumers is simply unsustainable.

During the call, management gave some colour on it:

Management reaffirmed that the overall trend for incentives is down, largely thanks to AI targeting.

They view incentives as a lever for frequency and engagement with the app, with the ultimate goal of attempting to change consumer behaviour and subsequently increasing margins.

Therefore, from Q to Q, they expect large fluctuations in incentives as they look for new ways to allow users to interact more actively with the app. Different incentive programmes will peak at varying periods.

Another risk I view is the GMV per MTU. Grab saw nearly 0% growth in GMV per MTU year on year which I believe is cause for concern. As Grab grows as a brand, it is important that pricing power increases, of which GMV per MTU is a relatively good measure for.

Perhaps I am reading too deeply and this is a positive for GRAB 0.00%↑ as it implies substantial upside as Grab begins to monetise its users in coming quarters. For as long as MTUs continue to increase at a steady rate, perhaps GMV per MTU is not too important of a metric yet.

Personal Thoughts

All in all, I am very satisfied with Grab’s earnings results and I believe my thesis for continued double digits growth has been validated by these earnings and management’s remarks.

I have personally increased my allocation to GRAB 0.00%↑ as my conviction on it has strengthened. I believe market is still severely undervaluing the company. I have written extensively on the reasons for this, which you can find on my X profile titled: “I believe Grab is undervalued for several reasons:”

Also of note, I have listened to several of Grab’s earnings call in previous quarters, and the tone has never been so bullish. Each member of the management team seemed to be falling over themselves trying to answer each question thrown by the analysts on the call. This is more likely than not a bullish signal that management believes the company has outperformed expectations.

Disclaimer: I am long Grab. The content presented in this thesis is for informational and academic purposes only and does not constitute financial advice. The analysis and opinions expressed are based on research and should not be interpreted as a recommendation to buy, sell, or hold any security. Readers should conduct their own due diligence and consult with a qualified financial advisor before making any investment decisions.

You made me realize how GFin could bring the company to the following chapters.

Fantastic article; thanks for sharing!