It is no secret that I am a big fan of emerging market businesses. I believe they are often overlooked by the market, which is exactly where alpha tends to reside.

Businesses such as Mercado Libre & Sea Limited have been great investments for investors over the past decade(s).

dLocal is a Latin American business that facilitates payments for large conglomerates on a B2B basis, specifically in underserved emerging markets. It is a capital-light “toll bridge” business with a decade-long head start in local rails.

At today’s price, the market is pricing in perpetual take-rate erosion and stalled growth, yet even a bear-case model points to a mid-teens IRR. In my view, the skew is asymmetric.

Below you will find a 10,000+ word deep dive into the business, diving into all aspects including company history, competitive analysis, bull theses, full excel valuation model and what i’m personally doing with dLocal.

This has taken nearly a 100 hours of deep research, I hope you enjoy!

Table of Contents

Introduction

Company History

Company Overview

Industry and Market Analysis

Competitive Analysis

Bull Thesis

GabGrowth Quality Score

Risks

Financials

Stablecoins

Ownership

Valuation

Concluding Thoughts (What I am personally doing)

1. Introduction

dLocal is a payments facilitator serving as a bridge between the world’s largest online businesses and consumers in emerging markets. It enables global merchants such as Amazon, Netflix, Meta and Uber to accept and disburse payments across 40+ countries in Latin America, Africa, and Asia.

This solves a core problem in emerging markets: consumers there lack access to international credit cards and traditional banking. dLocal steps in to handle currency conversion and settlement, so merchants can tap into these markets without building local payments infrastructure.

2. Company History

As I always say, I believe understanding the full history of the business provides important context for the business it has become today. Too often, investors focus on current financials, recent headlines, and/or forward guidance, neglecting the foundational decisions, cultural DNA, and problem-solving mentality that has shaped the business from the ground up.

In dLocal’s case, its history is a lens into evaluating its current strategy and leadership, and I believe that is crucially important for this thesis.

That’s why I’ll begin by walking through the founding story of dLocal and its evolution over the years. Only by understanding how and why the company was built, can we then fairly assess where it’s headed next.

2009-2016: Pre-dLocal Years, AstroPay

dLocal’s origin story begins with another fintech company: AstroPay, a Uruguayan payments company founded in 2009. AstroPay was founded by Sergio Fogel and Andrés Bzurovski, and focused on facilitating online purchases in emerging markets.

AstroPay was a consumer facing company, helping people in underbanked regions transact online without relying on traditional banking infrastructure. At the time, many Latin American consumers didn’t have access to international credit cards or even basic banking services. AstroPay solved this by offering virtual prepaid cards, digital wallets, and support for local payment methods.

A major chunk of AstroPay’s early volume came from high-risk verticals such as online gaming, sports betting, and forex trading platforms. These sectors were legally ambiguous, and many platforms operated without local approval. AstroPay became one of the preferred methods for users to fund these accounts, bypassing traditional banking systems.

While operating AstroPay, the team realised that the real infrastructure gaps weren’t just hurting consumers, they were crippling global merchants too. Leading global merchants wanted to sell in Latin America (and later Africa and Asia), but couldn’t navigate the fragmented payment systems like Brazil’s Boleto, Mexico’s OXXO, etc.

With AstroPay stable and profitable, the founders decided to spin out a separate company called dLocal, focused purely on cross-border B2B payments infrastructure.

2016-2017: The Origin Story

Fellow Uruguayan Sebastián Kanovich, who was employee number four at AstroPay, joined them as co-founder and CEO of dLocal.

The idea for dLocal first happened through Sebastián who stumbled onto the idea out of personal frustration. Specifically, his inability to purchase an NBA League Pass or shop online without borrowing a credit card from relatives and friends.

Sebastián saw the bigger opportunity: instead of only serving end users (at AstroPay), why not build the rails to help global companies enter emerging markets?

Their first product addressed Brazil’s Boleto system. This was a popular and long-standing payment method that allowed customers to make payments in cash without the need for a bank account or credit card. dLocal developed a digital solution that significantly shortened the process, allowing users to issue Boletos at checkout and complete transactions seamlessly. However, the team soon realised that payment challenges extended far beyond Brazil, and instead was an issue in almost every emerging market across Latin America, Africa, and Asia.

The team thus set out to solve this problem across various emerging markets. However, for the first few years, they were repeatedly told that going international meant Europe, not Latin America, Africa, or other developing markets.

Over time though, two things happened. Firstly, emerging markets became more relevant for global companies as they looked to grow faster. Secondly, dLocal realised that when they started integrating more payment methods, their value proposition to these businesses started to compound. Specifically, they were no longer just solving the Boleto problem in Brazil, but under the same API, they were solving it in Mexico, South Africa, Nigeria, Indonesia and more.

2018: First Big Break & Product Maturity

Their first big breakthrough happened with GoDaddy.com. dLocal initially attempted to be a B2C business, offering a prepaid card with its own branding. GoDaddy was blunt in their response, saying “No one cares about your brand. Give us the payment methods, so just go from the payment method to the cashier.” dLocal was a little offended at the start, but soon realised that they were right. It was more suited to be an infrastructure player.

After Brazil, dLocal began expanding across Latin America, adding Mexico, Argentina, Chile and Colombia. They built infrastructure for both collections and disbursements. dLocal also added local methods such as cash vouchers, bank transfers, and local wallets to its platform. They continued to focus on enterprise clients, rejecting SME and consumer-facing products.

dLocal also refined its role as a white-label payments provider and moved deeper into infrastructure-as-a-service, formalising key partnerships with banks, regulators and telecomm operators across regions.

2019: Scaling Globally

In 2019, dLocal began expanding into Africa and Asia, adding over 300 local payment methods to its unified platform. They began supporting cross-border payouts to freelancers, sellers, and creators. All throughout, they maintained capital efficiency: bootstrapped, profitable, and founder-led.

As more merchants began integrating into multiple markets, total payment volume and hence revenue growth started compounding significantly. From 2016 to 2020, dLocal compounded TPV at 97.4%, compounding from a $136M TPV in 2016 to $2.06B TPV in 2020.

2020: Hyper-growth and Pandemic Tailwinds

Covid-19 accelerated global e-commerce and demand for localised payments. dLocal began signing Tier 1 clients such as Amazon, Netflix, Microsoft, Spotify and even Didi.

They began supporting a large variety of use cases and industries, from ride-hailing to marketplaces, to streaming and gaming. dLocal’s business began scaling quickly, especially in mobile-heavy and cash-heavy economies.

At the same time, it raised a major funding round of $200M led by General Atlantic and became Uruguay’s first unicorn startup with a valuation of $1.2B. This was a pivotal validation of the business; proof that a startup from a small South American country could build a globally relevant FinTech platform.

The business continued to grow at nearly triple digits percentage, and reached $100M+ in revenue, with strong free cash flow and profit margins.

2021: NASDAQ IPO

In June 2021, dLocal went public on NASDAQ under the ticker DLO at $21 per share, raising over $617M at a $6.1B valuation. At the time, dLocal was operating in 29 countries, serving 325 merchants, and handling over $2.1B in TPV.

At its highest point in 2021, the stock hit an all-time high close of $65.73 with a market cap of $26.7B, reflecting enormous optimism for its growth prospects as e-commerce boomed in emerging markets.

2022: Crash & Fraud Claims

However, like many “pandemic winners” dLocal saw its stock price come back to earth. Post-Covid normalisation, rising competition and the end of the ZIRP era resulted in the stock seeing an 81% drawdown from Sept 2021 to Nov 2022.

In November 2022, famed short-seller Muddy Waters Capital published a scathing short report alleging that dLocal’s financials were misleading and possibly fraudulent. The report also highlighted “red flags” such as unexplained discrepancies in accounts, very high margins that raised skepticism, and insider stock sales. This led to dLocal’s shares falling over 50% in one day, from the mid-$20s to ~$10.

dLocal strongly denied short-seller allegations, calling them inaccurate and groundless claims and speculation. The Board formed an audit committee to review the claims and announced that key allegations were found “without merit”. Several top executives also departed around this period, for various reasons.

2023-2024: A New Face to Steady the Ship

To bolster credibility and steady the ship, dLocal brought in a heavyweight outsider: Pedro Arnt, the longtime CFO of Mercado Libre (Latin America’s leading e-commerce firm).

Pedro was hired in late 2023 and became co-CEO and eventually sole CEO by 2024. The move boosted investor confidence, triggering a >30% stock rebound. Pedro brought a structured, risk-aware management approach, focusing on remittances, treasury, invoicing, and fraud prevention.

In 2024, dLocal executed a $200M share buyback program, deploying its cash reserves strategically. In FY2024, TPV was $25.6B growing at 45% YoY with revenue of $750M growing 15% YoY. Net Revenue Retention stayed strong at 113% with notable growth in Africa, Asia and remittances.

2025: Re-Acceleration?

In 2025, dLocal has continued to move quickly. In the first quarter, it continued to grow its license portfolio, adding 3 new registrations to its portfolio, 2 in Argentina and 1 in Chile. Just last month, 3 new licenses were secured in the UAE, Turkey and the Philippines, bolstering its regulatory moat and enabling deeper in-market integration and merchant onboarding.

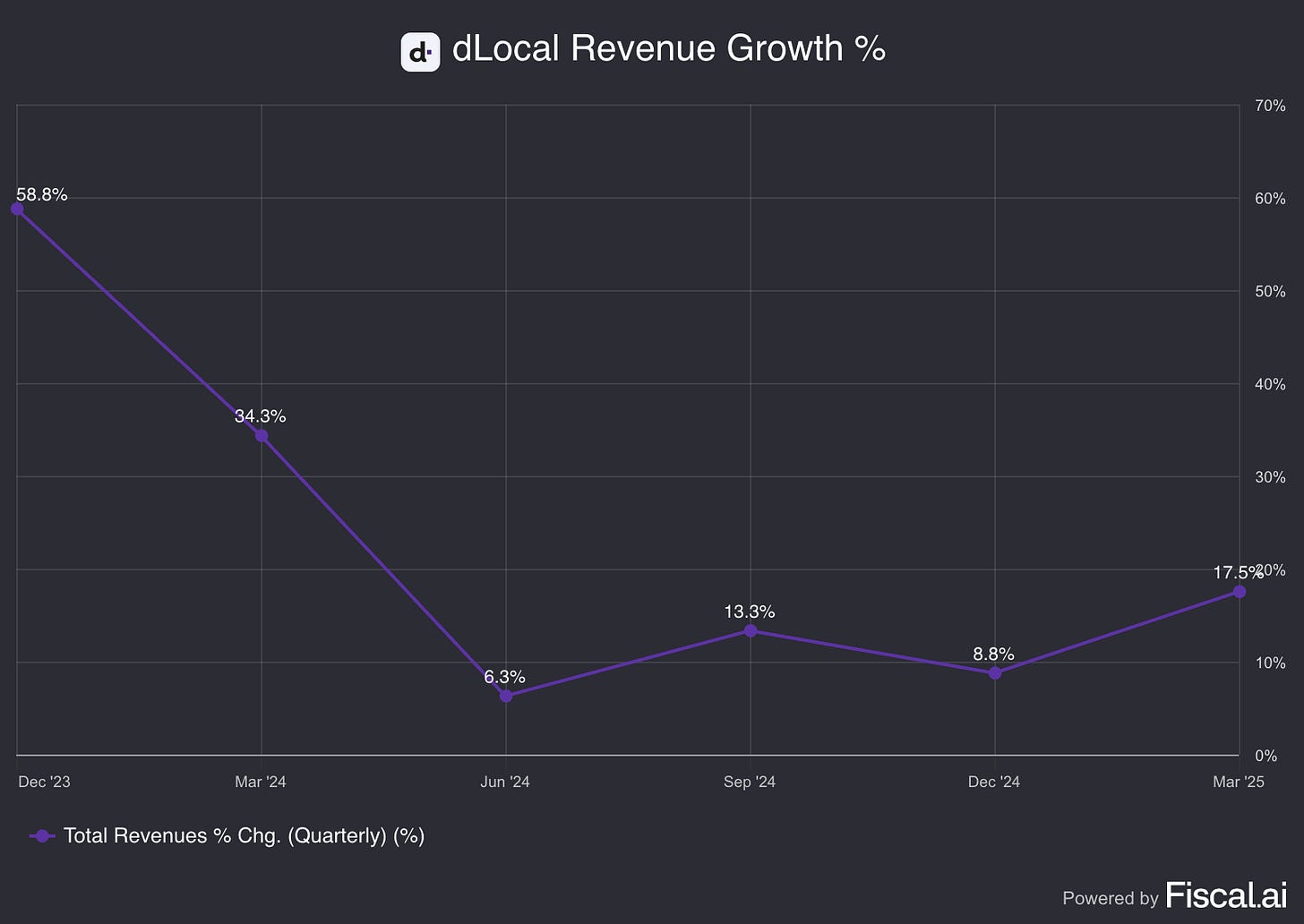

Momentum has continued into Q1 2025 with TPV growing 53% YoY, hitting a record $8.1B in quarterly TPV and revenue growing by 18% YoY, with a significant improvement in operating profit, growing 70.8% YoY to $45.8M.

A re-acceleration in revenue growth is often a strong sign as analysts scramble to adjust their price targets. A re-accelerating business is given a far higher multiple than one that is decelerating.

This is the crux of why I am interested in the stock today.

In summary, dLocal’s history can be characterised as rapid ascent, massive hype, a harsh comedown, and a rebuilding of trust. What began as a niche LatAm payment startup grew into a publicly traded global payments processor, encountered growing pains and controversy, and is now trying to prove it can deliver sustainable growth in a post-pandemic, increasingly competitive environment.

With that backdrop, let’s look closer at how dLocal’s business works and what makes it stand out in the FinTech landscape.

3. Company Overview

Value Proposition

dLocal makes it easy for global businesses to accept payments in emerging markets. Instead of dealing with dozens of local banks, partners, and complex rules, merchants just connect once to dLocal’s platform. That single connection takes care of everything, including local payment methods, regulations, and money transfers.

In places like the U.S. or Europe, credit cards are common and payment systems are straightforward. But in emerging markets, every country has its own unique way of doing things, making it tedious and expensive for businesses to expand quickly.

That is why companies like Amazon, Spotify, and SHEIN use dLocal. A single integration allows them to enter over 40 new countries quickly and cheaply, and offer a smooth experience for their local customers. It is this ease and efficiency that makes dLocal so valuable to global merchants.

How dLocal works exactly

dLocal operates through its “One dLocal” concept (one direct API, one platform, and one contract), where global companies can accept payments, send pay-outs and settle funds globally without the need to manage separate pay-in and pay-out processors, set up numerous local entities, and integrate multiple acquirers and payment methods in each market.

Specifically, this is how its “One dLocal” concept works:

One API: A single technical integration that gives merchants access to 900+ local payment methods in over 40 emerging market countries.

One Platform: Behind that API sits a cloud platform that handles authorisation, FX, fraud tools, reporting, pay-ins and pay-outs from end to end.

One Contract: Merchants sign one commercial agreement with dLocal, which means they do not need local entities, multiple PSP contracts or separate settlement flows.

This is key for merchants as they often want to go to market quickly, expanding live into new countries within weeks instead of months or even years.

This also allows merchants to avoid staffing local finance and compliance teams, ensure higher conversion of payments through dLocal’s expertise and operational simplicity with just one monthly invoice and one data feed.

dLocal provides 5 primary products/services:

1/ Pay-ins

Allows merchants to accept cards, cash vouchers, instant payments (e.g. Pix, OXXO, M-PESA), wallets and bank transfers in local currency while settling abroad.

The typical use cases are for e-commerce checkout, subscriptions and in-app purchases. Companies using this are Amazon, Spotify, Netflix, SHEIN, and Google.

2/ Payouts

Enables merchants to mass disburse payments to bank accounts, wallets or cash outlets in local currency, funded in FX, Fiat and eventually stablecoins (more on this later).

The typical use cases are for gig-worker payouts, refunds, supplier payments, remittances. Companies using this are Uber, DiDi (China’s Uber), PayPal, Upwork etc…

3/ dLocal for Platforms

Enables merchants to split, route and reconcile funds among multiple sellers or drivers with a single integration.

These are typically used for marketplaces, ride-hailing and delivery platforms. inDrive is an example of a customer that uses this service, primarily to disburse driver earnings across LatAm, Africa and Asia.

4/ Defense Suite

dLocal provides fraud scoring, real-time monitoring, charge-back management and dispute resolution as upsell services. These are typically used for high-velocity digital goods, gaming and travel.

Typical customers that utilise these services are TripAdvisor and Booking.com.

5/ Invoice Collection

Generates local-currency invoices linked to automated reconciliation and FX conversion. These are typically used for B2B SaaS businesses, cross-border wholesale and advertising networks.

dLocal cites Amazon, Spotify, and Microsoft as clients using their services for cross-border B2B receivables.

How dLocal makes money

dLocal generates revenue primarily through transaction fees on pay-ins and payouts. These fees can vary, from being a percentage of the total transaction payment value, to being a fixed fee per transaction, or even a spread on foreign exchange conversions.

dLocal also makes money through other add-on services such as its defense suite and invoice collection, as well as interest income on cash float, and hedging/treasury gains.

To make it simple, I’ll walk you through a typical transaction:

A Spotify subscriber in Brazil pays R$20 through Pix.

dLocal’s local partner clears the Pix transfer and passes the funds to dLocal’s Brazilian entity.

Transaction Fee: dLocal keeps, say 3% (R$0.60)

FX Spread: dLocal exchanges the remaining R$19.40 for USD at 5.35 instead of the 5.38 mid-rate. The difference of 0.03 is recognised inside dLocal’s transaction revenues, alongside the ordinary transaction fee.

A day or two later, dLocal wires USD $3.62 to Spotify’s treasury account. The brief float earns overnight interest that shows up in Finance Income.

As of FY-2024, transaction revenues (transaction fee + FX spread) make up 93% of dLocal’s revenues.

TPV Breakdown

dLocal facilitates two key types of flows: cross-border and local-to-local.

Cross-border payments involve money that is collected in one currency and settled in another (for e.g., a Nigerian user pays in Naira, the merchant receives USD). This segment is growing much faster than local-to-local at 76% YoY driven mostly by remittances, financial services, commerce, and streaming.

Local-to-local payments means the entire transaction is conducted within one country and currency. TPV in this segment grew 33% YoY with a slight 3% dip QoQ due to seasonality in Mexico and a volume loss with a large client.

As mentioned previously, dLocal offers two key products: pay-ins and pay-outs.

Pay-ins rose 49% YoY, reaching $5.4B, driven by commerce, on-demand delivery and streaming while pay-outs surged 61% YoY, reaching $2.7B mostly driven by strong growth from remittances and financial services.

4. Industry and Market Analysis

dLocal is primarily a cross-border payments business. However, it sits at the intersection of several sectors too, that are fundamental to the business.

Its business is driven by the growth of digital wallets, e-commerce, the gig-economy, remittances, streaming among others. These industries are the key driver of dLocal’s revenues and is essentially the bull case for the business.

Don’t take it from me, take it from dLocal’s CEO Pedro Arnt. On “The Enthusiast” podcast, he discussed his “aha” moment for dLocal. After backing several startups in emerging markets that all flopped, he had a realisation: dLocal stood out for one key reason:

“Your chance of success increases dramatically if you’re trying to ride that same wave of consumer digital adoption in Africa, in frontier Asia, in frontier Latin America not on the coattails of having to pick who the winners will be in these markets, but on the coattails of the large global companies that you know will be relevant, Netflix, Spotify, Google, Meta, whoever.

And so I realised, that’s really what dLocal is. It’s a bet on emerging market and frontier market digital growth de-risked by the fact you don’t have to pick a local winner because who they serve are the world’s largest and most successful consumer digital companies.

So if those companies do well across the emerging world, dLocal will do well because they’re basically a proxy for the growth of those companies across these under penetrated markets. And that to me was like, okay, this is exciting.”

Pedro Arnt, dLocal CEO

Understanding the growth vectors and friction points of each of these domains is critical to assessing the company’s runway.

In 2024, the crucial growth drivers of the business remained commerce, financial services, ride-hailing, and increasingly remittances, that grew by a whopping 99%.

Commerce

Southeast Asia’s platform GMV hit $128.4B in 2024 and is expected to continue compounding at double-digit rates for the coming decade.

Latin American cross-border e-commerce is expanding at a 34% CAGR, faster than domestic online trade. Meanwhile, Africa is on course for a $40.5B market by 2025.

Rising smartphone ownership, cheap mobile data and the rapid uptake of social commerce are key growth catalysts for commerce.

Digital Payments & Instant Rails in Latin America

Brazil’s Pix has exploded to 68.7 billion transactions in 2024, worth roughly $5 trillion, overtaking cards and cash as the country’s top payment instrument.

Latin-American e-commerce GMV will climb from US $183 billion in 2023 to $270 billion in 2028 (~8 % CAGR), with cross-border spend expected to top $115 billion by 2026.

Tailwinds: ubiquitous smartphones, popular voucher systems (OXXO, Boleto), and regulatory pushes for open banking.

Headwinds: volatile currencies and periodic capital-control shocks (e.g., Argentina 2023).

Mobile Money & Financial Inclusion in Africa

Africa processed 65 % of the world’s mobile-money value in 2024, about $1.1 trillion, and 82 billion transactions.

Real-time schemes (e.g., Kenya’s M-Pesa, Nigeria’s NIP) have become the de-facto payments OS for millions of under-banked users, opening the door for global merchants once rails like dLocal translate them into settled US dollars.

E-commerce GMV in the Middle East & Africa is set to nearly double from $155 billion in 2025 to $302 billion by 2030 (~14% CAGR).

Digital Payments Boom in South & Southeast Asia

Southeast Asia’s digital-payments value is projected to jump from $120 billion in 2023 to $306 billion in 2028 (~21% CAGR), fuelled by super-apps, QR standards, and government cash-less mandates.

India alone will see e-commerce soar from US $136 billion in 2025 to $327 billion by 2030 (~19% CAGR), with UPI accounting for more than half of checkout payments, an ideal use case for dLocal’s “collect local, settle abroad” model.

Ride-Hailing & On-Demand Mobility

Global ride-hailing revenue in emerging markets is $74.9B in 2025 and forecast to grow 16% a year to $287.6B by 2034.

Urbanisation, smartphone penetration and increasing consolidation in the market will allow for lower prices and increased demand for these services.

Cross-Border Payments Infrastructure

The global cross-border payments market is worth roughly $213B in fee revenue today and is forecast to grow to a $321B market by 2030.

The driver of this segment is simple: more merchants want to sell or pay its suppliers/workers abroad, yet traditional banking remains slow and expensive.

Emerging market corridors are the most fee-rich because they involve currency controls, exotic FX pairs and fragmented rails, the very frictions that dLocal specialises in and monetises.

Remittances & Gig-Economy Payouts

Remittances to low-and middle-income countries are on track to hit $685 billion in 2024, still larger than foreign direct investments.

The gig-economy market is worth $557 billion in 2024 and could reach $1.8 trillion by 2032, with “instant earnings” a top demand.

These flows require fast, low-denomination pay-outs to bank accounts, wallets or cash agents, exactly what dLocal’s Payout rails and FX engine provide.

Country Analysis

dLocal started in Latin America, hence a large majority of its TPVs flowed through the likes of Brazil, Mexico and Argentina. In 2021, after its IPO, 92% of TPV came directly from the region, with only 8% coming from its then-new Africa/Asia corridors.

However, as of 2024, Latin America has fallen to 75% of group flow, with Africa+Asia climbing to 25%, led by Egypt, Nigeria, South Africa, Turkey and India. Management has repeatedly highlighted these “frontier” markets as the fastest-growing TPV contributors.

dLocal has gone from a one-region play (LatAm) to a multi-continent processor in three years, with Africa + Asia now representing roughly a quarter of all payment volume, and growing 2-3× faster than the core.

Note that because dLocal no longer prints a TPV table by geography, I am using revenue mix and management commentary as the nearest observable proxy.

Bottom-Line Implications for dLocal

dLocal is riding a multi-decade tailwind in almost every key segment it is involved in.

The total addressable market is massive and growing, driven by these key segments. Cross-border payments, e-commerce GMV, gig-economy are all areas where we are likely to see double-digit growth for the coming decade.