Coinbase is a business I’m quite familiar with, having dabbled in the cryptocurrency space and used the product for several years.

I first bought the stock in October 2023 as it became clear to me that we were set for a crypto bull run. My entry was in the $70-90 range and I then exited towards the end of last year between the $250-$330 mark, generating a ~3.5x return over 1 year.

I believe there’s a potential second opportunity here. However, I want to make it clear that buying here is extremely risky, as it relies on timing crypto cycles, one that is likely in the latter stages of the run.

Full Disclosure:

I bought back into the stock at $200 on 9th May 2025 and made a post on X about it.

With that in mind, I will run through my thesis on Coinbase stock, my view on the underlying business and my plan moving forward.

Table of Contents

Company Overview

Bull Thesis

Risks

My Plan

1. Company Overview

Coinbase is the largest U.S.-based cryptocurrency exchange, offering a secure platform for individuals, institutions, and developers to buy, sell, trade, store, and stake crypto assets. Its services span across:

Retail Trading

User-friendly mobile/web interface for buying/selling crypto.

Generates revenue through transaction fees and spreads.

Over 100 million verified users globally.

Coinbase Prime

Comprehensive suite for hedge funds, asset managers, corporates.

Includes custody (Coinbase Custody), execution, and analytics.

Significant growth in institutional volumes and custodial assets.

Blockchain Infrastructure

Operates Base, its Ethereum Layer-2 blockchain.

Developer tools via Wallet-as-a-Service, Node infrastructure, and Smart contract APIs.

Key focus on building the “on-chain economy.”

Staking and Yield

Offers staking for cryptocurrencies such as Ethereum, Solana, and other assets.

Stablecoin Angle

Strategic partnership with Circle on USDC.

Earns 50% of interest income from USDC reserves until 2026; renewable until 2029. (Non-Compete till 2029 for Circle)

USDC is a major source of recurring high-margin revenue.

Essentially, think of Coinbase as a crypto bank and stockbroker rolled into one, for Bitcoin and other cryptocurrencies. It earns money through trading fees, interest from stablecoins like USDC, and by offering custodial services to institutional investors. Coinbase also runs its own blockchain called Base, which is designed to help developers build cheaper and faster crypto apps.

I think what truly sets Coinbase apart is how seriously it takes regulation — this has helped it become one of the few names in crypto that institutions and regulators actually trust. It is also one of the key reasons why it has become an important bridge between TradFi and Crypto.

2. Bull Thesis

My Coinbase bull thesis falls into two timeframes: Short-to-Medium Term and Long Term. I view Coinbase as a strong trading opportunity during crypto bull runs, but not a stock to hold through bear markets or prolonged downturns.

That said, I also believe Coinbase has the potential to become a truly great company over the next decade, one that long-term investors could be rewarded for holding as it matures into a foundational player in the crypto ecosystem.

Short to Medium Term:

Stablecoin Rails = Internet Money

Coinbase has a revenue sharing agreement with Circle, the company behind USDC, the 2nd largest stablecoin in the world, after the notorious Tether (USDT).

Recently, Circle filed for an IPO at ~$7B, with the stock eventually opening at $15B and now trades at $48B. Pretty crazy move.

Now here’s where it gets interesting: through the revenue sharing agreement, Coinbase is entitled to HALF of Circle’s USDC revenues, a revenue stream that amounted to $908M in 2024 alone. Just yesterday, the GENIUS act was approved in the US, which allows for issuance of stablecoins, legitimising USDC, something that was uncertain in the previous administration.

How much is Coinbase worth in a scenario that Circle is worth $48B and gives half of its revenue to Coinbase? Coinbase trades at $75B today.

Crypto Bull Cycle

Bitcoin is just 6% shy of all-time highs, and 41% above the 2021 highs. Add to that the tailwind of potentially lower interest rates and a robust risk-on economy, I believe we could see a surge into Q4 2025.

Yet, Coinbase stock is still 30% below its 2021 highs and has underperformed Bitcoin this cycle, despite its dominance in the exchange space. I believe an extended Bitcoin cycle in H2 this year could be a huge tailwind for Coinbase stock.

Long Term:

Regulatory Tailwinds & Trusted Position

Coinbase is, in my view, the best-positioned platform to ride the wave of mainstream digital asset adoption. As regulators crack down on offshore and unregulated exchanges, Coinbase stands out as the go-to name: trusted, compliant and fully transparent.

Looking at the crypto exchange landscape, the major players are Binance, Coinbase, Bybit, OKX, and Huobi. Of these 5, 4 operate largely in the Asian and Middle Eastern regions, and are headquartered from the likes of Cayman Islands, Seychelles, etc. (not exactly the most trustworthy places… remember FTX in the Bahamas?)

Coinbase is the only one that operates primarily in the Western hemisphere, is based in the US, and with real regulatory credibility. They’ve been laser-focused on compliance since day one, and that’s now paying off big as the industry matures.

Visionary Founder

Founder and CEO Brian Armstrong understood that the business had to be extremely law-abiding to stand out as the sole trustworthy centralised exchange in an industry where many have resorted to shortcuts and scams.

He brings rare founder-CEO continuity and a long-term mission mindset that has steered Coinbase through extremely volatile periods. Since founding the company in 2012, he has consistently prioritised compliance, user trust and scalability. He maintains an extremely disciplined operating mindset and I believe is on par with the likes of Vlad Tenev and Brian Chesky.

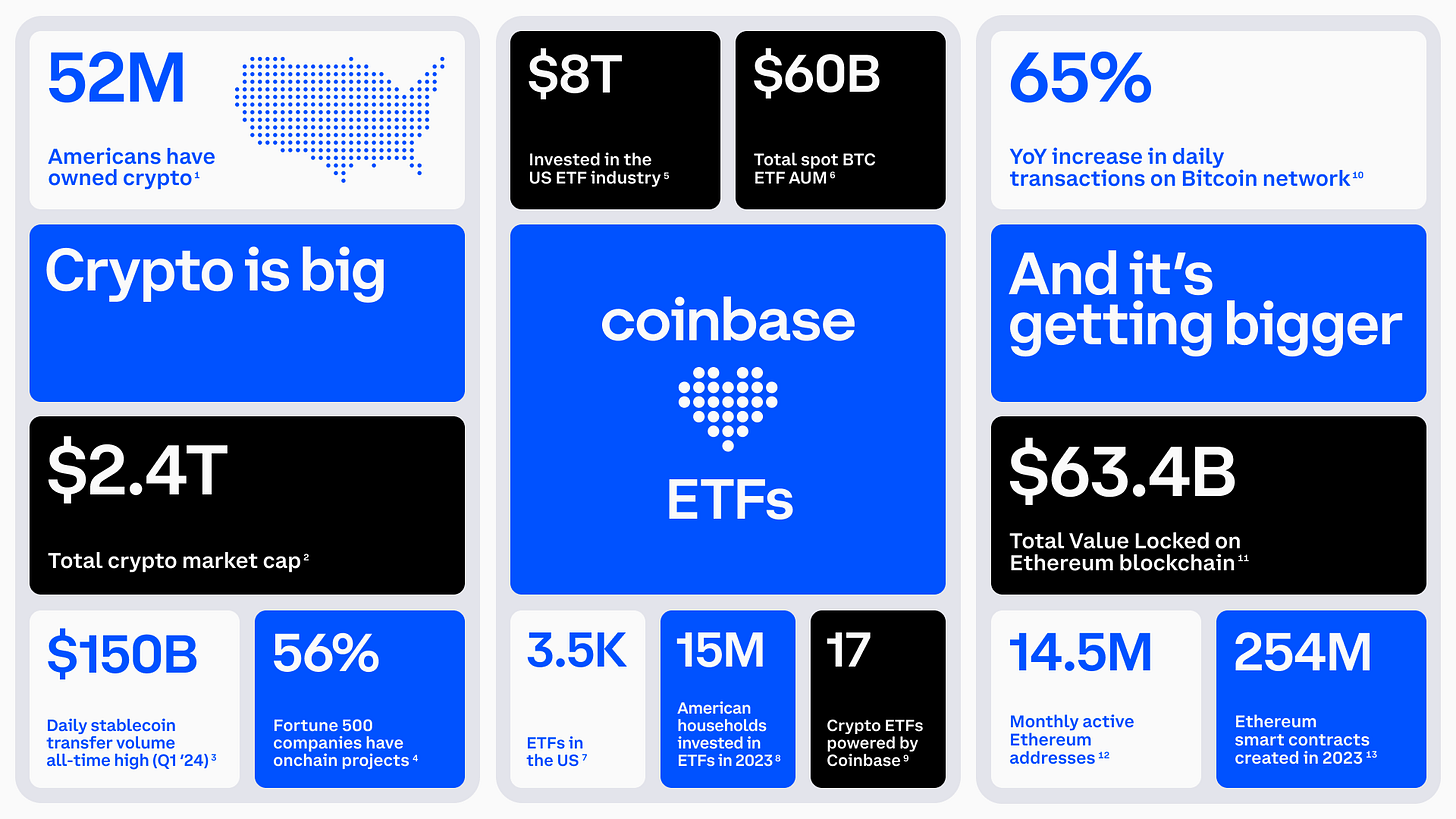

ETF Custody Tailwind

Coinbase is the official custodian for 8 of 11 spot BTC ETFs and 8 of 9 spot ETH ETFs. Custody fees are c. 10-15bps of AUM and scale linearly with flows and are non-cyclical. Blackrock’s IBIT alone is over $70B in AUM. That’s $70-100M in custodian fees from IBIT alone.

These institutions with spot BTC ETFs control in total over $16T in assets.

“They see a variety of ways that crypto can benefit their clients, from serving as a safe haven when turmoil hits traditional financial markets, to providing portfolio diversification, to countering the effects of expansionary fiscal and monetary policy.”

-Coinbase Website

Derivatives Growth: Acquisition of Deribit

In May, Coinbase announced the acquisition of Deribit, one of the largest derivatives exchanges in the world for $2.9B, making it the largest M&A deal in Crypto history.

Derivatives are 10x the size of the spot market, provide a more stable revenue stream and by nature is extremely capital efficient. It is also incredibly popular among institutions. This deal makes Coinbase a full-stack provider for retail and institutions.

Base: Layer 2 Traction

Coinbase’s Layer-2 blockchain, Base, has the potential to open new on-chain monetisation opportunities as crypto use cases evolve beyond speculation.

It is currently already processing around 10 million transactions per day, far more than the Ethereum L1, and each transaction pays sequencer and potential MEV fees to Coinbase. As the network becomes the default rail for the Coinbase wallet as well as the commerce and payments stack, these “toll” fees could evolve into a utility-like revenue stream, largely immune to market cycles.

The Backbone of Crypto

Coinbase is building the infrastructure backbone of the crypto economy, attempting to become a blend of Nasdaq, AWS, and Visa for the blockchain world.

If crypto really takes off in adoption as a new financial layer that powers everyday transactions at scale, Coinbase would be the key cog in the machine: the rails, the clearinghouse, and the interface that makes it all tick.

3. Risks

In the short term, there are significant risks to owning Coinbase stock. The stock is ultimately tied to Bitcoin stock as the key determinant of the business’ transaction revenues and sentiment. In bear markets, volumes collapse, incentives rise and retail interest fades extremely quickly. Coinbase stock will likely face a minimum 70% drawdown in such an event (which is a matter of when, not if imo).

Longer term, there are more risks for Coinbase, but of smaller magnitude and lower probability.

Coinbase’s revenue sharing agreement with Circle ends in 2026, with a further 3 year renewal extremely likely (due to a non-compete for 3 years post 2026). Without the backing of a strong crypto exchange, USDC will falter behind the other competitors. However, in 2029, there could be issues and Coinbase could potentially lose all revenue from this agreement.

Foreign exchanges are well funded and could impact Coinbase’s market share, especially in international markets. In the US, this is less likely to happen due to Coinbase’s dominance and tighter regulation.

USDC market share erosion. A flood of stablecoins are bound to enter the market in the coming months and years with the passing of the GENIUS act. If that trend accelerates, it could hurt one of Coinbase’s fastest-growing and highest-margin revenue lines.

US elections will be of key focus. As of today, the Republicans are much more pro-crypto while the Dems have been very strict with regulation, to the point of “strangulation by regulation”.

Execution risk, Custody fee compression are among the other risks that I believe you should contend with in the long term.