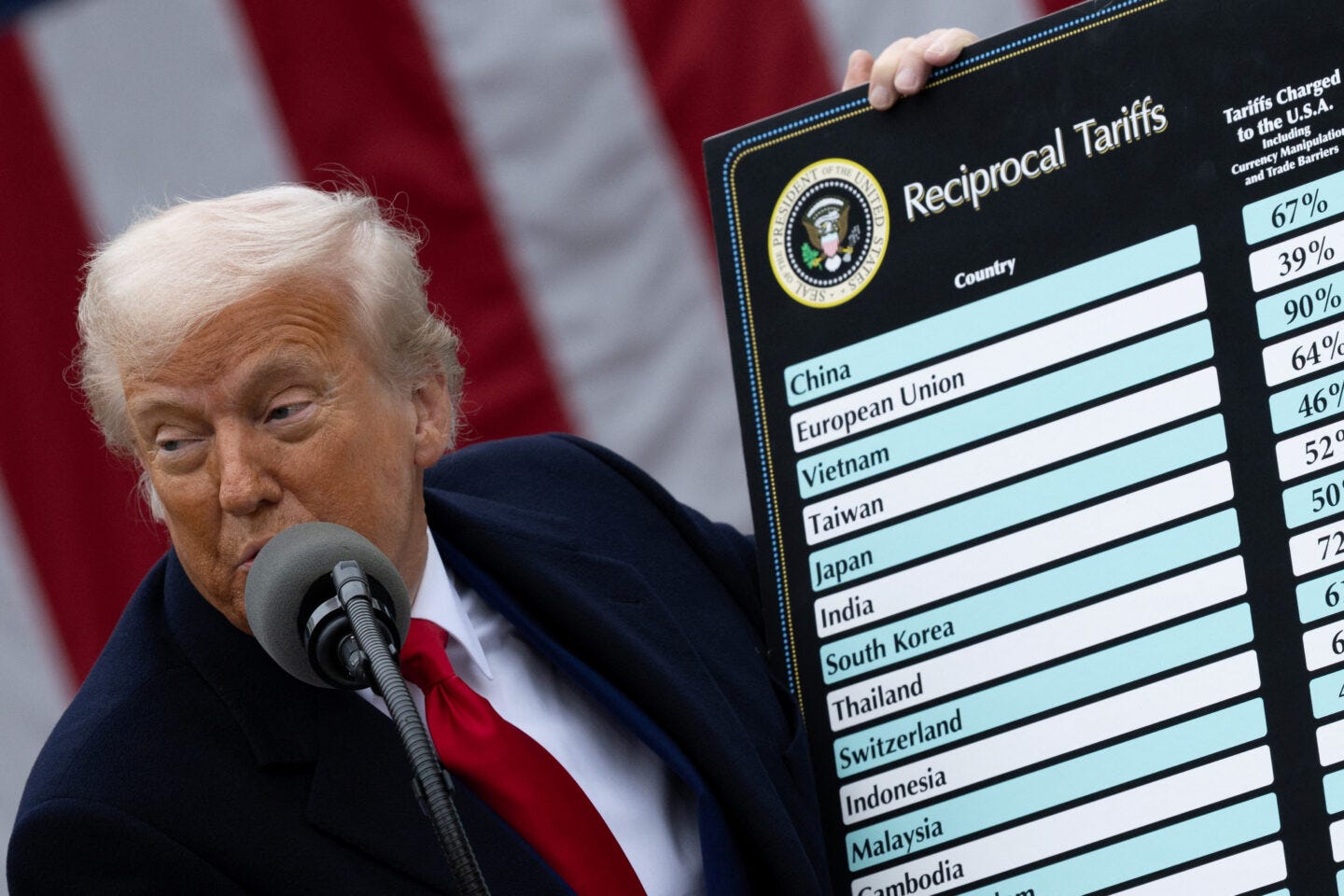

Hey all, with the blanket tariffs that Trump has placed on all imports, I’m shifting part of my focus toward companies insulated from global trade shocks.

Specifically, I’m looking for asset-light businesses that are primarily service-based, with no physical goods, allowing them to have little to no exposure to tariffs while sustaining high margins.

This is the list I have come up with:

Microsoft (MSFT)

Cloud, Azure, Office: Minimal Reliance on Hardware

Fair Isaac Corporation (FICO)

Credit Scoring, Analytics Software, Zero Physical Goods

Intercontinental Exchange (ICE)

Owns NYSE, Provides Data and Clearing Services

S&P Global (SPGI)

Ratings and Financial Data Providers

Netflix (NFLX)

Subscription Content, Zero Import/Export Exposure

Spotify (SPOT)

Subscription + Ad-Supported Users, Zero Exposure

CrowdStrike (CRWD)

Cybersecurity with Cloud-Native Delivery

CME Group (CME)

Futures & Derivatives Exchange; Earn Fees from Volume.

Duolingo (DUOL)

Language Learning App, Fully Digital

Booking Holdings (BKNG)

Online Travel Agency, Marketplace Model, Asset-Light

I will go through 4 main segments for each stock, namely “What They Do”, “Why It Fits”, “Margin Profile” and “Tariff Risk”.

This will give a rough explanation of the business and my rationale for deciding that these are generally Tariff-Resistant Businesses.

Microsoft

What They Do:

Dominates Enterprise Productivity (Office 365), Cloud Infrastructure (Azure), Developer Tools (GitHub), and Operating Systems (Windows)

It also owns LinkedIn and is a key player in AI through its investment in OpenAI.

Why It Fits:

Asset-Light: Microsoft generates majority of its revenue from software and cloud subscriptions, businesses that have zero exposure to tariffs.

High-Margin: Office 365 and Azure are among the highest-margin enterprise software offerings. Azure has ridden the cloud wave for the last decade with a 38% CAGR and its gross margins continue to expand with scale.

Service-Based & Sticky: Office and Teams are deeply embedded in enterprise workflows. The long-term enterprise licensing model provides recurring, predictable revenue.

Margin Profile:

Microsoft has continued to grow its absurdly high gross & net margins as the business has scaled over time.

Its Gross Margins now near the 70% mark while Net Profit Margins now near the 35% mark.

Tariff Risk:

Their revenues are geographically diversified, but their delivery is entirely digital.

There is no reliance on physical goods subject to tariffs.

Fair Isaac Corporation (FICO)

What They Do:

Fair Isaac Corporation invented the FICO credit score and is a household name.

It now provides predictive analytics, scoring algorithms, and decision-making software used by banks, insurers, and other enterprises to manage risk, lending, and fraud.

Why It Fits:

100% Software and Analytics, Zero Physical Goods

Recurring Revenue from Long-Term Institutional Clients

Deeply Embedded in U.S. Financial Systems

Margin Profile:

Gross Margin: 80.2%

Operating Margin: 42.9%

Best-in-class margin profile with strong pricing power and limited need for sales headcount due to institutional dependence.

Tariff Risk:

FICO has no trade exposure, relying entirely on IP and software licenses.

Intercontinental Exchange (ICE)

What They Do:

ICE owns the NYSE and operates global financial exchanges, selling trading access, clearing and proprietary data.

Why It Fits:

Earns fees from digital trading activity, not physical trade.

ICE owns digital infrastructure that is critical to capital markets.

More Volatility = More Volume = More Revenue

Margin Profile:

ICE reports net revenue to reflect its take after passthrough costs.

The best margin profile to consider for the business is operating margin which is strong, at 47.7%, but has notably on a downward trend in the past 10Y.

The reason for this is a shift in revenue mix for the business:

ICE has expanded into Fixed Income and Mortgage Tech.

These segments generate recurring SaaS-like revenue, but have lower operating leverage compared to the ultra-high-margin derivatives exchange.

Mortgage Tech has been a drag on the business due to falling mortgage volumes (caused by interest rate hikes slashing loan originations) and acquisitions (Ellie Mae+Black Knight cost $24B in total) among other reasons.

Tariff Risk:

ICE operates digitally with no product logistics and hence zero tariff exposure.

S&P Global (SPGI)

What They Do:

S&P Global is a financial intelligence company that provides credit ratings, financial indices (S&P 500), benchmark data, and real-time market intelligence.

Why It Fits:

It is a backbone of global financial markets.

It is an “Information-as-a-service” business, with no physical products.

It serves corporate and institutional clients that tend to be very sticky.

Margin Profile:

S&P Global has best-in-class margins with GM nearing 70% and OPM at 40%.

Of note is the steep fall in margins in 2022. The reason behind this:

$44B Acquisition of IHS Markit in Feb 2022

SPGI is the 3rd largest firm by annual revenue in the space, with IHS Markit being the 8th largest. This was a calculated move that saw a $3.8B one-time bump in 2022 revenue to $11.18B.

M&A often comes with significant one-time costs including legal fees, severance & restructuring costs, systems integration etc…

Collapse in Debt Issuance Activity

Fed Interest Rate Hikes, Volatility in Credit Markets, Geopolitical Tensions led to global bond issuance plummeting.

Since 2022, margins have started to climb and could be a potential tailwind for the business moving forward as synergies begin to be realised from the merger.

Tariff Risk:

SPGI provides intangible services, not physical goods.

Its revenue is entirely independent of global trade of goods, therefore Trump’s blanket tariffs is unlikely to have any first order consequences on its cost structure or revenue.

There are a few potential second order consequences:

Tariffs could cause a slowdown in corporate bond issuance → SPGI Ratings Business could take a hit.

Tariffs on Commodities could alter trading flows, potentially impacting benchmark demand or data services.

I do believe these are relatively minor consequences that will have a limited, short-term impact to the business.

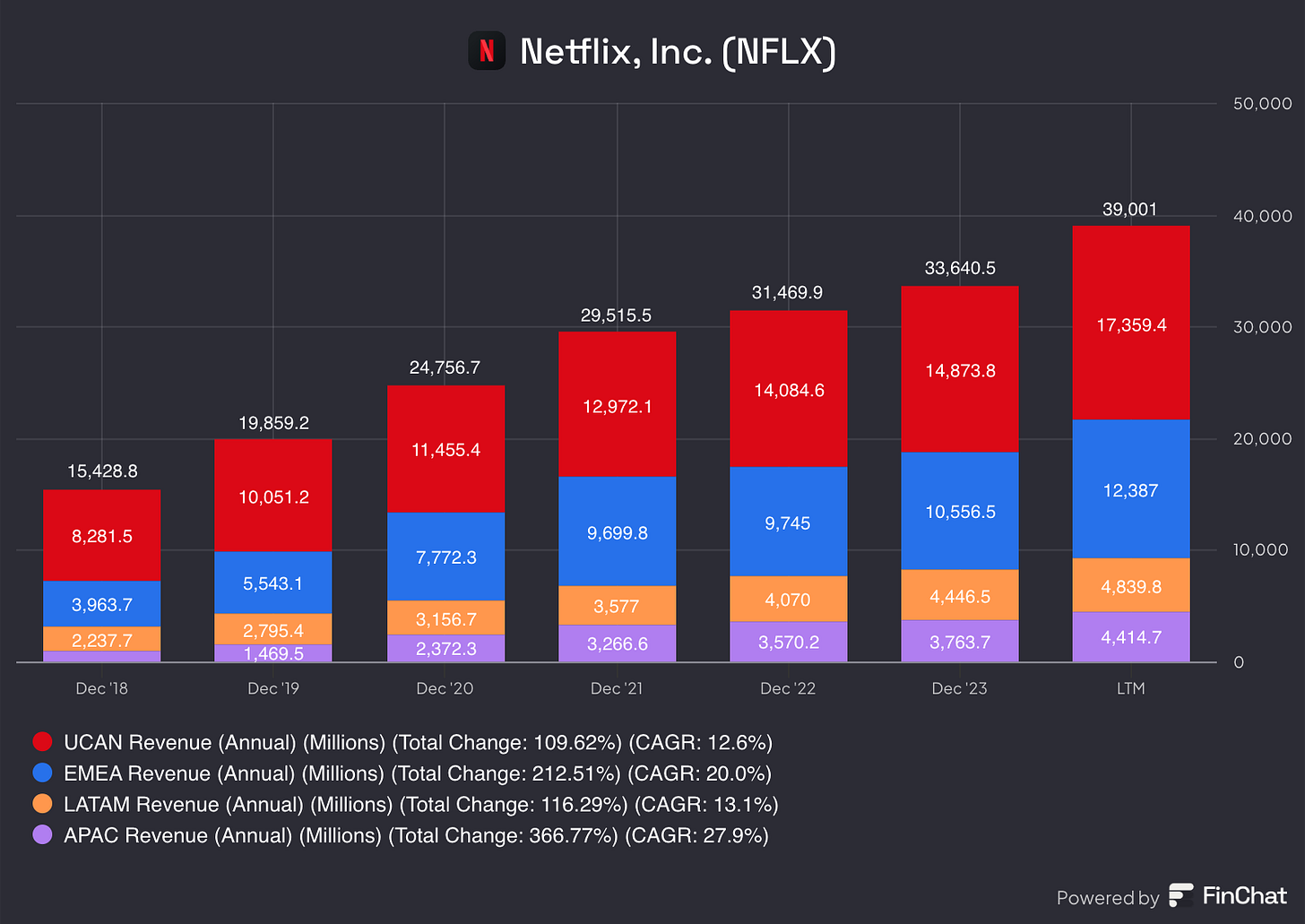

Netflix (NFLX)

What They Do:

Digital Streaming Platform that produces and distributes original and licensed video content globally.

Why It Fits:

Netflix provides fully digital distribution.

It operates a pure platform model with zero physical delivery.

Margin Profile:

Netflix has seen a steady increase in margins over the past 10 years with particularly impressive growth across its operating margin profile, with a 6x increase.

Margins have been improving recently with content amortisation discipline and growing pricing power as smaller competitors have faded. It is currently in a margin expansion phase that is a strong tailwind for the stock.

Tariff Risk:

Netflix is highly insulated from tariffs for several reasons:

No Physical Goods = No Direct Tariffs

Global Business with Localised Delivery

Netflix earns 55-60% of its revenue from international markets. In each country, it localises content production, minimising the risk of US-origin tariffs affecting delivery abroad.

For example, “Money Heist” (Spain), “Physical 100” (South Korea), and “Delhi Crime” (India) are all locally produced and consumed, not cross-border physical exports.

Netflix could be affected indirectly of course, with currency fluctuations, weakened consumer demand and regulatory retaliation being potential factors. However, these are generally minor risks.

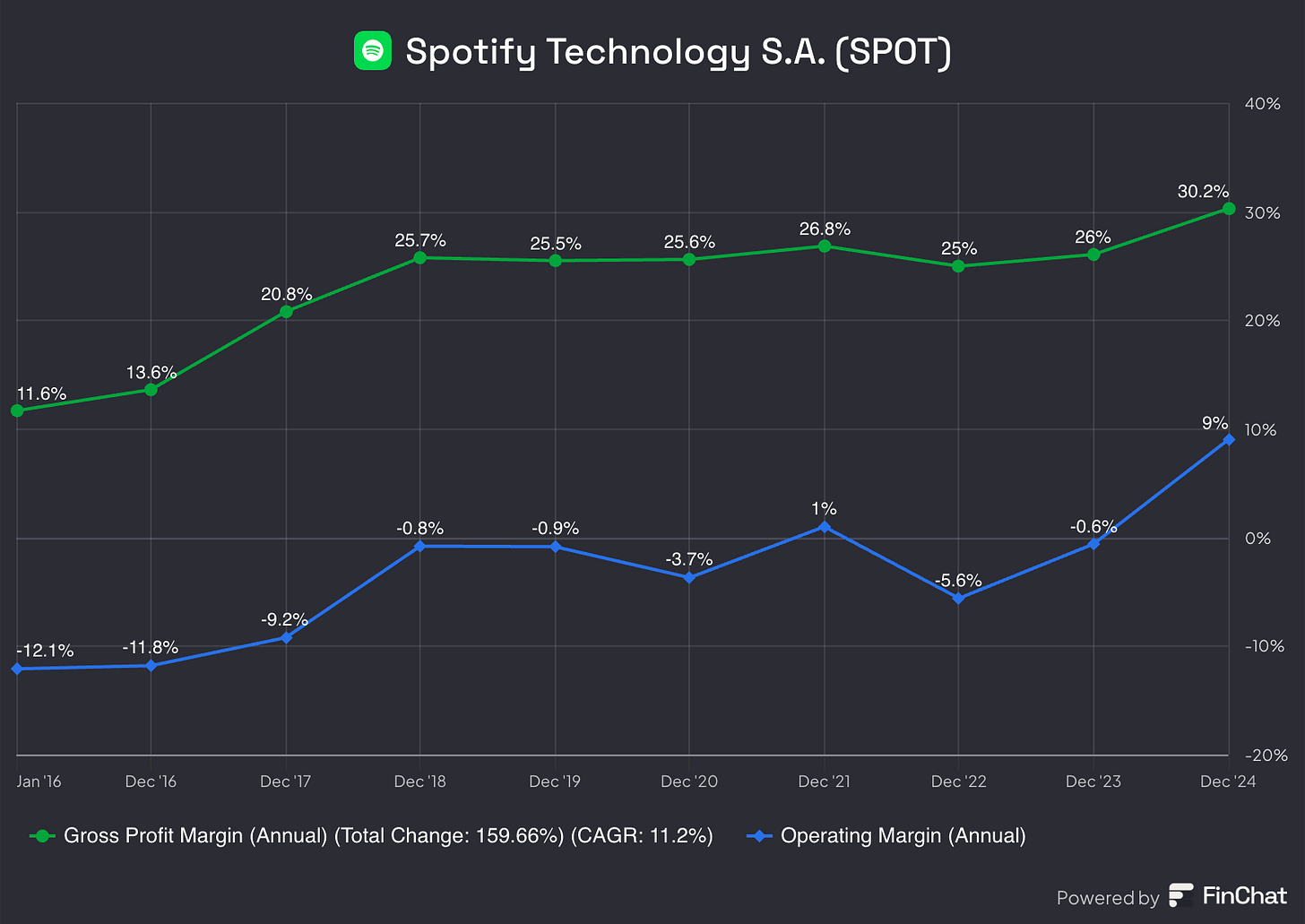

Spotify (SPOT)

What They Do:

Spotify is a global audio streaming platform with both premium and ad-supported models. It has also expanded into podcasts and advertising infrastructure.

Why It Fits:

Spotify is an entirely digital business with no goods produced or sold.

Spotify merely monetises audience attention.

Margin Profile:

Spotify’s margins have reached escape velocity, with its GM improving over time thanks to better deals with record labels, growth in podcasts and audiobooks, which inherently have higher margins, and more direct distribution.

Operating Margins have just turned positive as the company begins to push towards operating leverage as it scales.

Premium ARPU is stabilising

Ad-Supported Revenue is growing faster

Podcast profitability has improved post-cost cuts and layoffs in 2023-2024.

Management expects long-term GM and OPM margins of 30-35% and 10-15% respectively.

Tariff Risk:

Spotify, like Netflix and other digital service providers, has minimal direct exposure to tariffs, but there are some indirect macro and regulatory risks worth noting.

Indirect Tariff-Related Risks:

Currency Translation Headwinds

Consumer Discretionary Spend

Retaliatory Digital Regulations

CrowdStrike (CRWD)

What They Do:

CrowdStrike is a cybersecurity company that offers a platform called Falcon, which provides endpoint security, threat intelligence and cyberattack response services.

Think of Falcon as a program that detects threats before it happens and protects businesses from hackers, viruses and cyberattacks.

Why It Fits:

CrowdStrike is a cloud-native software. Unlike old-school antivirus software, Falcon runs from the cloud, making it faster, lighter, and easier to update. Being a pure digital service, they are immune from tariffs.

CrowdStrike has no hardware or inventory, operating a purely SaaS structure with sticky enterprise contracts.

Margin Profile:

CrowdStrike's gross margins have expanded steadily since inception with the business. Gross Margins have likely now reached their terminal value at 76%.

Operating Margins are now at ~0%, a stark improvement from the -171% 8 years ago.

However, CrowdStrike as a business is already very profitable, with SBC weighing down on margins.

FCF, which excludes SBC, has extremely healthy margins in the 30% range.

Tariff Risk:

CrowdStrike is highly insulated from tariff risks:

Falcon platform is delivered entirely via the cloud.

CrowdStrike operates globally but the US remains its core market. International exposure does exist, notably EMEA and APAC, but tariffs on services and digital goods are unlikely to happen.

Unlike hardware-based cybersecurity companies (e.g. Palo Alto’s firewalls), CrowdStrike has zero reliance on parts, chips, or OEMs that could be hit by tariffs.

CME Group (CME)

What They Do:

CME Group is the world's leading derivatives marketplace, operating several exchanges including the Chicago Mercantile Exchange (CME), the Chicago Board of Trade (CBOT), the New York Mercantile Exchange (NYMEX), and the Commodity Exchange (COMEX).

It provides a platform for trading futures and options contracts on a wide range of asset classes, including interest rates, equity indexes, foreign exchange, energy, agricultural products, and metals.

Why It Fits:

CME earns revenues from digital financial transactions, not physical goods.

Data and Clearing Services add sticky revenue.

Margin Profile:

CME runs on a highly-scalable, asset-light business model with revenues coming directly from trading fees, market data and clearing services. Costs are mainly tech infrastructure, personnel, and regulatory compliance.

Their Gross Margins are exceptional, at ~98%, typical of exchanges. Operating Margins and Net Profit Margins are in the mid 60s to 50s respectively.

Tariff Risk:

CME is effectively insulated from tariff risk.

No physical goods.

Operates mainly in the US with some global access points but revenue is not dependent on cross-border physical trade.

In fact, CME could actually benefit from trade volatility.

Duolingo (DUOL)

What They Do:

Duolingo is the world’s most popular language-learning app that uses mobile and web delivery to teach users across over 40 languages.

Duolingo uses a gamified model to teach users of all levels.

Its business model includes freemium access, paid subscriptions, and ads.

Why It Fits:

100% digital platform, no textbooks or inventory.

Scalable EdTech platform with strong brand and virality.

Margin Profile:

Duolingo has an extremely strong margin profile.

Gross Margins are in the 70% range, typical for digital subscription businesses, with the only cost being content delivery-related costs.

Operating Margins have improved significantly as R&D and marketing spend start to scale slower in comparison to revenues.

Tariff Risk:

Duolingo is almost entirely insulated from tariffs:

It is a digital-only platform with no hardware, physical goods or import/export.

It runs on Apple/Google platforms with no reliance on global trade for revenue collection.

The only theoretical exposure would be if app stores were restricted in certain regions (such as China).

Booking Holdings (BKNG)

What They Do:

Booking Holdings is the world’s largest online travel company, best known for running major travel platforms such as Booking.com, Priceline, Agoda, Kayak, Rentalcars.com, OpenTable.

Why It Fits:

It runs a platform model with no physical inventory.

It earns directly from commissions and advertising revenue, revenue lines that are unlikely to be affected by tariffs.

Margin Profile:

Booking has extremely high operating leverage with Gross Margins of over 85% and Operating Margins of over 30%.

Tariff Risk:

Booking, similar to most of the businesses in this article sells digital services, not physical goods.

Its business is insulated from tariffs, but sensitive to travel restrictions, currency fluctuations and geopolitical risk.

These 10 businesses are exceptional, and I believe they are well-positioned to thrive regardless of macroeconomic conditions. They have an extremely strong track record and the majority appear to be in a strong position to continue dominating their respective niches.

I will be covering each of these 10 businesses in depth in subsequent articles. If you found this piece helpful, I’d strongly encourage you to keep these names on your watchlist.

On a personal note, I’ve long admired FICO, CrowdStrike, and Booking Holdings. I held CrowdStrike for several years before exiting due to valuation concerns.

That said, many of the businesses on this list often trade at a premium — a reflection of their consistent quality over a long period of time.

Thank you for reading!

As usual, my posts remain free for all subscribers.

I would like to give a shoutout to FinChat.io.

It is in my opinion, the best tool for investors.

They provide access to fundamental analysis, financials going back 10 years, screening tools, insider trades, earnings reports, all in one place.

I use it everyday in my learning journey on the greatest businesses in the world and cannot recommend them enough.

If you would like to support my work and gain access to the best tool in finance, click on this link and get a 15% discount off the monthly subscription.